Jun 8, 2020

Consumer sentiment ticks up for a 6th straight week in Canada

, Bloomberg News

'There is a second war going on' for the prosperity of Canada: Nik Nanos

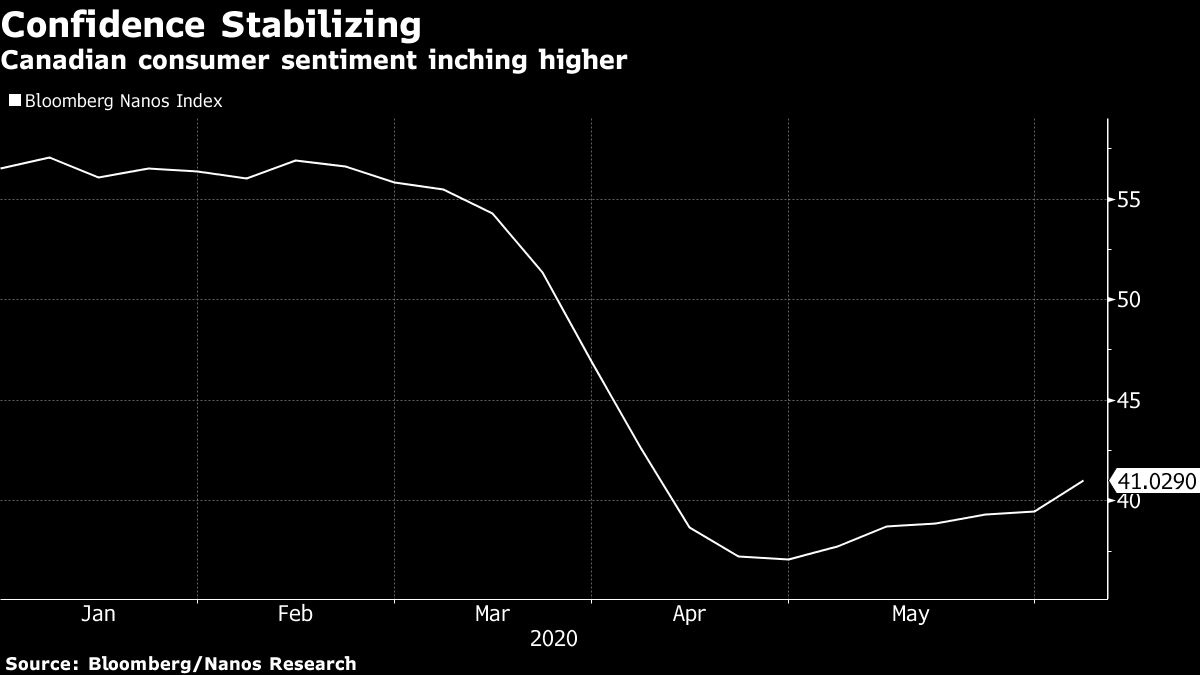

Consumer confidence continues to show signs of improving in Canada, inching higher for a sixth straight week.

The Bloomberg Nanos Canadian Confidence Index, based on a random survey, ticked up slightly to 41 last week, from 39.5 a week earlier.

While the index remains near its worst-ever readings recorded in April, the rise in confidence is consistent with other data that suggest economic activity is resuming as the country gradually reopens from Covid-19 restrictions.

In a welcome surprise, Canada created nearly 290,000 jobs in May, Statistics Canada said on Friday. Economists had been expecting a loss of half a million positions.

Every week, Nanos Research surveys 250 Canadians for their views on personal finances, job security and their outlook for the economy and real estate prices. Bloomberg publishes four-week rolling averages of the 1,000 responses. The index averaged 57 in the year prior to the crisis.

- Canadians are increasingly buying into the idea that impact of the pandemic has peaked, with 15.2 per cent saying they believe the economy will strengthen over the next six months. Pessimists still outnumber optimists by almost five to one, with 69 per cent saying the economy is weaker. That’s still better than a few weeks ago when 80 per cent of Canadians saw the economy weakening with only 7 per cent expecting it to strengthen.

- Fewer Canadians -- at 37.1 per cent last week -- are reporting that their personal finances have deteriorated. While still above average, that number had reached 42.3 per cent in April.

- Job security is returning to more normal levels. The share of respondents who said they are at least somewhat secure in their job hit 63.8 per cent, within striking distance of pre-crisis averages of about 66 per cent.

- Canadians remain sour on real estate, even though here too there has been some improvement in sentiment over the past two weeks. About 45 per cent anticipate a drop in home prices in the next six months, which is three times historical averages.