Feb 16, 2023

Consumer Spending in Canada Is Holding Up Despite Higher Rates

, Bloomberg News

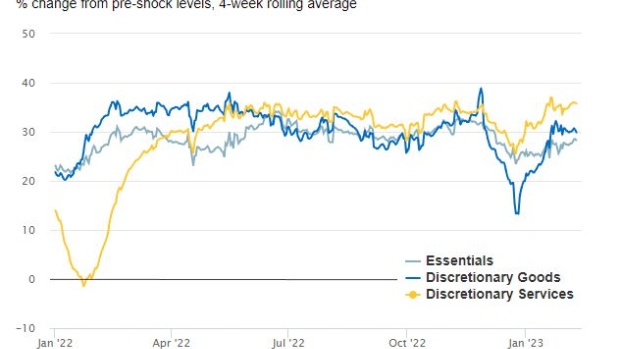

(Bloomberg) -- Consumer spending in Canada is running strong in February despite the central bank’s aggressive increases to borrowing costs, data from Royal Bank of Canada show.

Cardholder spending at the beginning of this month was up by about a third from pre-pandemic levels, according to tracking released Thursday by Canada’s largest commercial lender.

Consumption “has yet to show signs of slowing,” according to Carrie Freestone, the economist who authored the report. The average daily number of restaurant transactions was slightly higher in January, compared with pre-Covid levels, and jewelery sales in advance of Valentine’s Day were similar to last year’s levels.

“Higher debt servicing costs and lower real wages have yet to induce a pullback in discretionary spending — though we still expect these factors to eat into household purchasing power,” she wrote.

The numbers add to recent evidence that Canada’s economy may be running hotter than expected. Strong employment growth is also raising questions about when the Bank of Canada’s forceful interest rate hikes will start to crimp growth. The central bank’s forecast is that growth will stall in the first three quarters of this year, helping to reduce inflationary pressures.

Governor Tiff Macklem declared a conditional pause last month, saying policymakers would move to the sidelines and assess the impact of their hikes. But he warned the bank would consider raising rates again if it sees an “accumulation of evidence” that inflation and the economy aren’t cooling fast enough.

Overnight swap markets are betting the Bank of Canada may be forced to deliver another increase to interest rates as early as July. That’s a change from the beginning of this year, when markets were betting on rate cuts later in 2023.

Also on Thursday, Canadian Imperial Bank of Commerce revised its growth forecasts upward, removing projections for a technical recession this year, citing “more elbow room for non-inflationary growth” than previously estimated.

A slowdown in consumer spending is still expected by most economists this year, dragging growth to a halt. The majority of Canadians recently polled by Nanos Research Group say they’ll be squeezed if rates stay at the current 15-year high.

©2023 Bloomberg L.P.