Apr 19, 2023

Copia Is Latest Africa-Focused Startup to Roll Back Expansion

, Bloomberg News

(Bloomberg) -- Copia Global Inc., an Africa-focused e-commerce company, became the latest startup to roll back expansion plans amid concerns of a funding slowdown.

The company is exiting Uganda and cutting 350 employees to concentrate on its main East African market in Kenya, Copia said on Wednesday. Startups on the continent are facing a stark decision on whether to keep expanding or focus on profitability with venture capital funds drying up.

“This is the right move for Copia given the market environment,” the company’s Chief Executive Officer Tim Steel said. “By focusing our resources on our Kenyan business, we can assure short-term profitability and long-term success. This means pausing our international expansion plans, including suspending our Ugandan operation.”

Copia joins other firms that have scaled back their Africa operations in the wake of the financial crisis last month, highlighted by the collapse of Silicon Valley Bank. Financial technology companies Wave, Chipper Cash and Kuda, fresh produce firm Twiga Foods, as well as door-to-door deliverer Sendy have all announced cost-cutting measures, including laying off employees.

Funding Slowdown

“We will work hard to reach the point when we can restart our PanAfrican plan,” Steel said in an emailed response to questions. The capital markets are rewarding companies that can accelerate profitability and demonstrate cash frugality, Steel said.

Copia announced a $50 million funding last year and planned to further raise as much as $100 million to expand in West Africa. The company has since secured funds from its current investors, and it’s using the money for measures aimed at attaining profitability, a communications executive for the firm said without giving details.

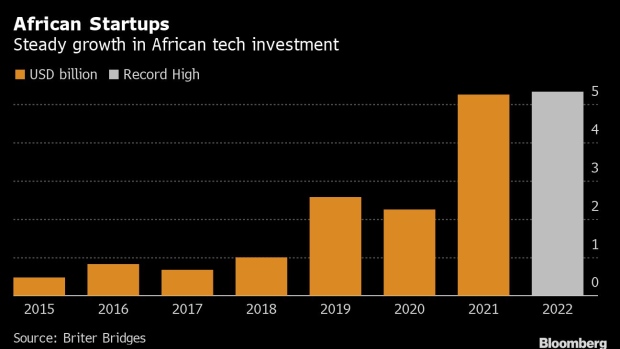

Africa has been seen as a potential hotbed for startups, with a young population whose increased use of technology helped funding to climb to a record last year, despite a global slowdown. That exception may be ending.

African startups raised $1.3 billion in the first three months of the year, 24% lower than the same period in 2022, according to data from Briter Bridges, a market intelligence company. There were 195 deals in the period through March, 45 fewer than the same quarter last year.

Investment rounds, particularly for the early-stage investors in Africa, will take longer to close as funds deal with banking issues following the collapse of SVB, according to Eliot Pence, co-founder of venture capital firm Tofino Capital.

Some investors, including Maurizio Caio, founder and managing partner at investment firm TLcom Capital LLP, are, however, still optimistic. The collapse of SVB will reduce venture debt for US startups, but it will have little impact on Africa, according to Caio. Financial firm Partech projects debt financing on the continent to continue to grow over the next couple of years.

Venture capital on the continent could increase to $7 billion this year, Caio said in an interview, partly basing his projection on money that’s been raised and in the pipeline for deployment. TLcom is in the process of allocating $150 million. Partech raised €245 million ($268 million), while Adenia Partners increased its fund-raising target to $500 million after it secured $300 million in September.

The retreat of western investors as central banks hike interest rates means the “pricing power has certainly moved toward VCs,” Caio said. The pivot to quicker profitability instead of ramping up growth is a “tragic mistake” for African startups, he said, adding, they “need to continue to grow until they reach the critical mass.”

©2023 Bloomberg L.P.