Apr 18, 2022

Corn nears record high, wheat surges on crop supply concerns

, Bloomberg News

Macro trends point to a possible commodities supercycle: Portfolio manager

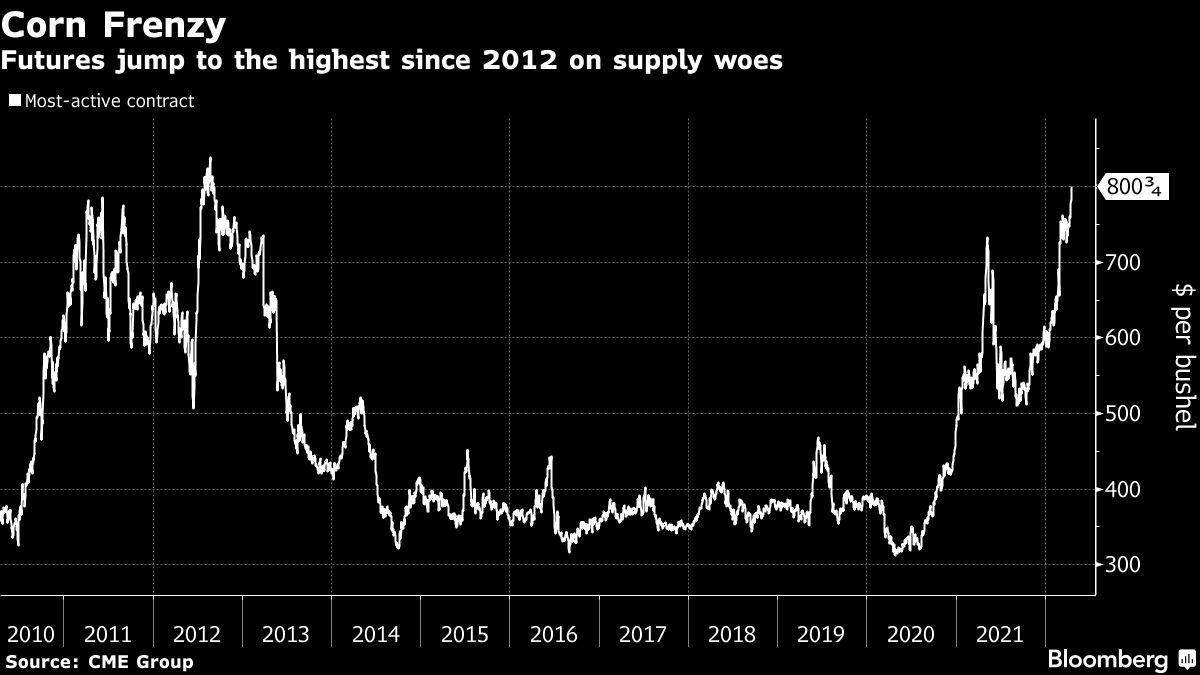

Corn futures in Chicago exceeded US$8 a bushel for the first time in almost a decade, approaching a record high as war threatens global supplies, boosting demand for U.S. grain.

The most-active July contract rose 3 per cent to US$8.07 a bushel in Chicago with the conflict in Ukraine showing no signs of easing as Russian forces attacked Mariupol overnight. Futures are nearing an all-time high of US$8.49 a bushel reached in 2012 after devastating drought and heat damaged crops in the U.S. Midwest. Wheat contracts surged as as cold and snow slowed planting.

The global outlook for corn supplies has taken a hit as Russia’s invasion of Ukraine disrupts farming and trade flows in a region responsible for about a fifth of exports. Not only that, but spring planting is also a worry now. That comes on top of a surge in fertilizer costs that’s dimming planting prospects in the U.S., the world’s top shipper. Demand is increasing as well. The U.S. Department of Agriculture reported multiple sales this month of American corn to China exceeding 1 million tons.

“People are also watching closely China’s economy, COVID lockdowns and demand for commodities, especially corn”, Naomi Blohm, senior market adviser at Total Farm Marketing in West Bend, Wisconsin, said in a note on Monday.

Ukraine’s next corn crop could fall almost 40 per cent from last year, a local grain association said earlier this month. U.S. farmers are poised to plant more soybeans than corn for just the third time ever as record fertilizer prices prompt growers to turn away from the cost-intensive grain.

The rally in corn and wheat helped the Bloomberg Agriculture Spot Index, which tracks farm products including soybeans, sugar and cotton, reach a record. Soybean futures touched US$17 a bushel, before settling 2.2 per cent higher at also closed higher with the most active contract reaching US$17 a bushel before paring gains.

Benchmark wheat futures in Chicago rose as much as 3.5 per cent and settled 2.2 per cent higher at US$11.2875 a bushel, as colder than expected weather across the Canadian Prairies and North Dakota threatened to slow planting. For the spring wheat seedings, the USDA’s latest crop progress report showed that 8 per cent of the expected area was planted, against 18 per cent last year.

For the U.S. winter wheat crop conditions, the USDA showed another reduction in good to excellent condition at 30 per cent, below the 32 per cent expected by analysts surveyed by Bloomberg and 53 per cent a year ago.

“We are not seeing a lot of warm temperatures and soil temperatures are not coming up as fast as they should. This will be a problem in May, if this trend continues,” David Tolleris, owner of WXrisk, said in a report. In the U.S., the cold weather is delaying corn plantings as well. Only 4 per cent of the corn area was seeded, against 7 per cent last year.

Parts of Canada’s Prairies have 8-10 inches (20-25 centimeters) of snow on the ground after a spring storm, said Joel Widenor, meteorologist at Commodity Weather Group. Another storm is forecast to bring as much as 12 inches (30 centimeters) of rain and show to southeastern Saskatchewan and Manitoba this weekend, he said. The lows in Winnipeg may sink to 3 degrees Fahrenheit (minus 16 degrees Celsius) Monday, according to Environment Canada.

The start of planting in parts of the country may be delayed by a week to 10 days, said Ken Ball, a senior commodity futures adviser at PI Financial.