Jan 22, 2021

Corn Prices Fall Most in 17 Months to Pace ‘Brutal’ Crop Selloff

, Bloomberg News

(Bloomberg) -- Corn prices plunged the most in 17 months, pacing a rout in agriculture futures on escalating coronavirus woes and a rally by the dollar.

“It’s brutal,” said Matt Bennett, co-founder of AgMarket.net and an Illinois farmer. “It looks to me like the funds are selling the heck out of corn and beans, which is interesting because we had huge export sales” reported earlier in weekly data from the U.S. Department of Agriculture, he said.

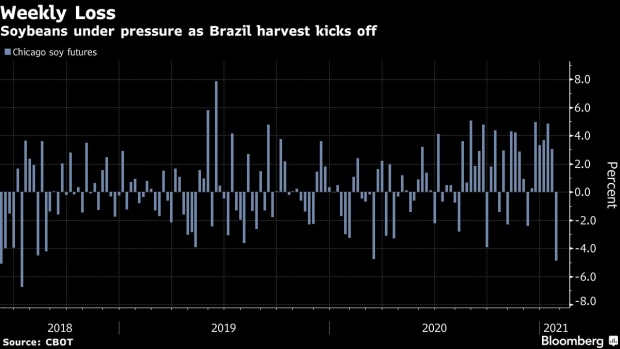

Soybean futures capped the biggest weekly drop in six years, wheat posted the largest daily drop since August 2019, and corn dropped by the exchange limit in Chicago. Last week, the trio of prices reached multiyear highs on South American supply concerns and booming demand in China.

On Friday, Covid-19 restrictions tightened from Germany and the U.K. to Hong Hong, and the European Central Bank cautioned that the euro area is headed for a double-dip recession. A gauge of the dollar snapped a four-day slump, damping the appeal of raw materials priced in the greenback.

After the settlement, U.S. government data showed hedge funds cut net-long positions in corn and soybeans. On Friday morning, export-sale figures in the week ended Jan. 14 showed soybean shipments more than doubled from a week earlier, and grains climbed.

Corn futures for March delivery tumbled 4.5% to close at $5.005 a bushel on the Chicago Board of Trade, the biggest drop for a most-active contact since Aug. 12, 2019. Earlier, the price fell by the exchange limit of 25 cents. This week, the grain slumped 5.8%, the most in 10 months.

Soybean futures for March delivery declined 4.3% to $13.1175 a bushel, the largest decline since Aug. 10, 2018. This week, the oilseed plunged 7.4%, the most since July 2014.

Soybean production in Brazil, in the world’s biggest grower, may be 132.4 million tons, said Andre Pessoa, president of Agroconsult. While the forecast eased from November, the projection still marked a record high. Average yields have climbed, and recent conditions have been favorable.

Wheat futures for March delivery fell 4% to $6.345 a bushel, the biggest drop since Aug. 12, 2019. This week, the price dropped 6.1%, the most since August.

Oat futures tumbled by the exchange limit of 20 cents a bushel to the lowest this year before paring losses. Soybean meal dropped 3.8%, and soybean oil fell 2.7%.

In New York, raw sugar, arabica coffee, cotton and cocoa dropped.

©2021 Bloomberg L.P.