Jan 24, 2023

Corporate Bond Bonanza May Be Too Much, Too Soon

, Bloomberg News

(Bloomberg) -- Global high-grade debt markets are blazing a path to a record rally and companies have sold more than $400 billion of bonds in January alone.

But the sheer speed and ferocity of the advance has left some fund managers asking: Is it all happening too soon? They’re studying economic reports that point to a feeble global economy, with incomes eroded by inflation and interest rates creeping higher.

Credit buyers are getting a green light from the Federal Reserve nearing the end of its hiking cycle, the US not staring at an economic abyss and inflation slowing, according to Scott Kimball, managing director of fixed income at Loop Capital Asset Management. But Kimball is cautious on valuations and says he “would not be running in to buy all the credits he can get his hands on where spreads have rallied.”

“There’s too much banking on the Fed in particular slowing, or changing policy, without a tremendously strong signal that they are ready to do so,” Kimball said in a phone interview Tuesday. The average risk premium on US high-grade bonds ended Monday at 122 basis points, the lowest since April 2022.

Treasury curve inversion after a rally signals “we are not out of the woods yet” on the economy, said Kimball. He anticipates better buying opportunities amid spread widening and markets volatility.

“We believe that as the economic reality becomes clear, that we may have avoided the worst-case scenario, but still will likely fall into a negative environment for corporates,” said George Goncalves, head of US macro strategy at MUFG. He’s warning against any view that the tightening in credit markets is the beginning of a durable trend.

Still, it’s easy to see why traders have jumped into risk this year. Bonds are trading at yields that were unattainable during the era of central bank largesse and many believe that investment-grade companies are financially sound and can weather the economic turbulence.

Investment-grade corporate bonds globally have gained more than 3.6% since the start of 2023, putting them on track for a record January return, based on Bloomberg indexes. Meanwhile worldwide debt sales are off to a brisk start, with companies from Morgan Stanley to Telecom Italia SA raising more than $400 billion this month.

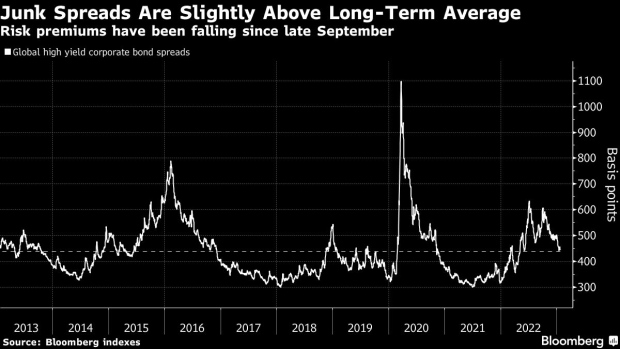

Markets are still being lifted by optimism that the inflation fight is nearing an end, reducing the need for more central bank rate hikes. The debt rally has taken average yields on global high-grade company notes to 4.8%, down from a peak at 5.8% in October. Even junk bonds, which stand to lose the most in a recession, have been rebounding.

There are now signs emerging that these gains could run out of steam. Risk premiums in both high-grade and junk bonds globally stand only a few basis points above their 10-year average, despite concerns of a looming economic slowdown.

Fraser Hedgley, head of client portfolio managers at Nomura Asset Management, said he’s started hedging some riskier parts of his portfolio, particularly emerging markets. “We have to be careful about positioning close to consensus,” he said.

With Europe’s company earnings season about to pick up pace, all eyes will be on how firms are navigating an environment that’s seeing customers tighten their belts while prices stay elevated. The region’s stock market is also showing signs of overheating, with a four-month rally starting to look stretched.

Premiums Evaporate

On the supportive side, portfolio managers are flush with cash, with high-grade funds in both the US and Europe reporting several weeks of inflows, according to Bank of America-compiled data by EPFR Global. This “could keep any setback in cash spreads shallow,” Marco Stoeckle, head of credit strategy at Commerzbank AG, wrote in a note.

Some money managers are getting increasingly cautious when spending this cash though, particularly in the hot market for new debt issuance.

“New issue premiums appear to have almost entirely evaporated. Deals are being tightened aggressively and not leaving value,” said Gordon Shannon, a portfolio manager at TwentyFour Asset Management, who’s bought only one of the more than 180 bonds offered in Europe so far this year.

“The spreads some deals are coming at, particularly hybrids — are pricing in zero volatility this year and that’s too rich for me,” Shannon said. “While recent data suggests the chances of a soft landing have improved, recession remains my base case and that needs a prudent approach.”

Sign up for The Brink, our newsletter chronicling corporate bankruptcies, distressed debt, and turnaround stories, delivered Tuesdays and Fridays.

Elsewhere in credit markets:

Americas

Strategists at Citigroup Inc. say high-yield investors should increase their allocation to one of the riskiest segments of corporate credit as inflation continues to show signs of cooling

- Default rates across speculative-grade debt in both the US and Europe are set to double this year, according to strategists at CreditSights

- Buyers of the riskiest slice of collateralized loan obligations are stepping up efforts to ensure the transition from Libor doesn’t end up costing them millions of dollars in potential returns

- Serta Simmons Bedding filed for bankruptcy with plans to trim its debt load and settle a creditor fight stemming from an earlier, out-of-court restructuring

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Issuance in Europe’s primary market broke a previous record for January set in 2020, hitting €244 billion ($265 billion) on Tuesday with a week of the month still left.

- Banks are offloading some of the risky buyout debt that’s weighed down their balance sheets after the expiration of key restrictions

- Investcorp hired Suhail Shaikh, a senior executive from Franklin Templeton-owned Alcentra, to expand its private credit business

- Closely-followed credit traders Hamza Lemssouguer and Sofiane Gharred guided their hedge funds to gains in 2022 after recovering from double-digit declines earlier in the year

Asia

Most Asian markets are closed for the Lunar New Year.

- Holders of additional tier 1 bonds by India’s Yes Bank may receive shares if the Supreme Court upholds a lower Bombay court order that rejected a decision to write off 84.15 billion rupees ($1 billion) of the notes, the Economic Times newspaper reports, citing people familiar

- US stocks and junk bonds are not pricing in enough risk of recession in 2023, according to Nicholas Ferres, chief investment officer for Vantage Point Asset Management in Singapore, which outperformed last year thanks to bets on China’s rebound

(Adds investor comment starting in third paragraph, updates regional sections.)

©2023 Bloomberg L.P.