Nov 22, 2022

Corporate Brazil Is Holding Up Fairly Well. Stocks, Not So Much

, Bloomberg News

(Bloomberg) -- Brazil’s corporate earnings gave little reason for investors to lose their cool, with profits that were mostly above or in-line with Wall Street expectations. Still, they are giving shares no relief.

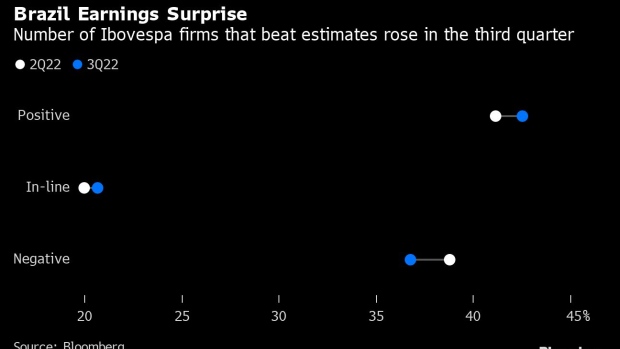

About 63% of companies in the nation’s benchmark Ibovespa equity index exceeded or met analysts’ estimates for the third quarter, up from 61% for the three-month period ended in June, Bloomberg data show. The average one-day price change following the results, however, was a 2.2% drop, compared to a 0.6% gain in the second quarter, as analysts and money managers blame the ongoing macroeconomic volatility for the souring Brazil mood.

Concerns over Brazil’s fiscal trajectory under a Luiz Inacio Lula da Silva presidency have kept the local equity market under pressure. Lula is yet to nominate his economic czar, and his transition team unveiled a proposal to indefinitely remove the country’s flagship social program from the public spending cap rule, which is seen by investors as a key fiscal anchor.

The uncertainty over the path of fiscal accounts -- and its effect on interest rates -- is pushing investors to the sidelines. Morgan Stanley, which earlier this month called Brazilian corporate earnings “solid” in a preliminary review of results, downgraded the nation’s stocks in its Latin America portfolio Sunday.

Morgan Stanley Downgrades Brazil as Lula Imperils Value Play

“Companies have been resilient and able to navigate the current scenario,” XP Inc.’s equity strategist Jennie Li said in an interview. “But we’re starting to get a bit more cautious going into the fourth quarter and early 2023.”

Brazilian stocks are down more than 8% in dollars this month, the worst among major global indexes.

In a tough environment, misses were punished even harder. Banco Bradesco SA had its worst day since 1998 after its recurring net income came in 22% below the average estimate. Retailer Magazine Luiza SA tumbled more than 13% after posting losses and Via SA suffered its worst week since the onset of the pandemic amid the results.

“The macroeconomic environment changed a lot in the last three weeks,” Rafael Martins, vice president of finance and investor relations officer at US-listed Brazilian payments firm StoneCo Ltd., told analysts in a conference call Thursday. It’s “difficult to say where this will end.”

Uninspiring forecasts and comments about the coming quarters also have money managers more cautious. Traders are reassessing the pace and timing of Brazil rate cuts as Lula’s multi-billion dollar social spending plan adds pressure on inflation. Higher rates dampen the mood for stocks, and could spark higher funding costs for companies in sectors such as payments.

Brazil Analysts Lift Rate Bets as Lula Readies More Spending

“It’s been hard to hear extremely optimistic words from management teams -- and equally difficult for them to make plans and give guidance when there are such big question marks,” Marcos Peixoto, a Rio de Janeiro-based portfolio manager at XP Asset Management, said in an interview.

--With assistance from Ricardo Strulovici Wolfrid and Leonardo Lara.

©2022 Bloomberg L.P.