Mar 1, 2022

Covid Hampers Hong Kong's Growth While Singapore Races Ahead

, Bloomberg News

(Bloomberg) -- Hong Kong’s escalating Covid-19 crisis and its desperate bid to rid the population of the virus is pushing the economy into contraction again.

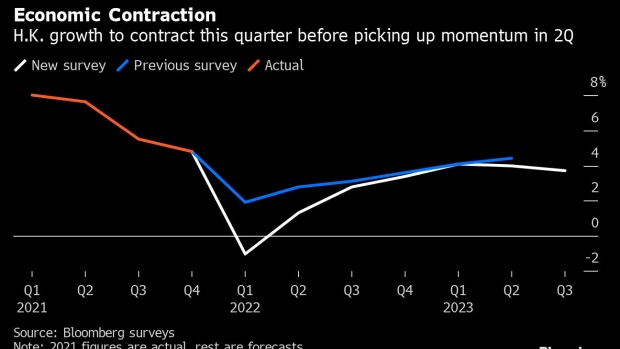

Economists have been downgrading their growth forecasts for Hong Kong this year alongside the government’s ever-tighter virus control measures, from travel bans to business closures. With mass testing of residents on the cards in March, more disruptions to the economy are expected. Gross domestic product is now predicted to contract 1% in the first quarter, according to a Bloomberg survey of economists.

While growth is set to rebound in the second quarter, the outlook is far from clear, given speculation of a full lockdown in the city. That would be unprecedented for Hong Kong and raise the prospect of an extended slump in the economy. There’s been no official information of a shutdown yet, though residents are already emptying store shelves to prepare for the worst.

For the full year, the median estimate for GDP growth is 2.4%, down from 3% in an earlier survey. But even that’s optimistic to some, like Bank of America economists, who have cut their projection to 1.6%. Under a worse-case scenario, they see the economy shrinking in the first half and growth weakening to just 0.2% for the full year.

“In such a scenario, the consumption impact would be more significant” with persistent partial lockdowns and more people fleeing the city, BofA economists including Bum Ki Son, wrote in a report. “This would also deal a bigger blow to many business sectors, which have struggled against multiple headwinds since the second half of 2019.”

The gloomy outlook comes even after the government announced a bigger-than-expected budget in February, doling out consumption vouchers for residents and extra spending on health care and vaccines.

On top of that, Hong Kong is also bracing for higher interest rates. The city imports its monetary policy from the U.S. due to a linked exchange rate with the dollar, which means it will be forced to raise borrowing costs when the Federal Reserve hikes. That would push up business costs, hurt consumers and weaken the property market.

The economy had only just begun recovering, expanding in 2021 after two years of contraction following the pandemic and social unrest. The outbreak of the highly-infectious omicron virus variant has caught officials off-guard this year and put Hong Kong’s strict Covid Zero strategy under pressure. As hospitals and quarantine facilities reach over-capacity, the government has been forced to backtrack on some of its restrictions, allowing patients with mild symptoms to now recover at home.

The worsening outlook has damaged Hong Kong’s reputation as an international hub. Citigroup Inc. is moving some of its staff out of Hong Kong to other places like Singapore, while several businesses are working on contingency plans as the pandemic measures force them to re-evaluate their operations in the Chinese territory.

Rival hub Singapore is expected to post GDP growth of 4% this year, according to a separate survey of economists, unchanged from earlier predictions.

“The poor government policy making in Hong Kong means Singapore is now attracting more capital and labor outflows from Hong Kong,” said Gary Ng, an economist at Natixis SA. The city’s Covid Zero approach and ever-changing policies “will push talents away in the short run,” he said, saying the shift could be permanent.

Still, Hong Kong has been an important gateway between China and the rest of the world, serving as a financial hub with a favorable tax rate. Economists expect Hong Kong’s growth to recover to 3% in 2023 -- the same pace as in Singapore, according to the Bloomberg surveys.

“While firms are relocating staff and certain departments, there’s been no exodus of companies,” said Lloyd Chan, an economist at Oxford Economics Ltd. “We still think Hong Kong will be able to leverage its position as a key gateway in and out of China.”

©2022 Bloomberg L.P.