Nov 26, 2021

Covid Risks Can Still Derail U.K. Recovery, BOE’s Pill Says

, Bloomberg News

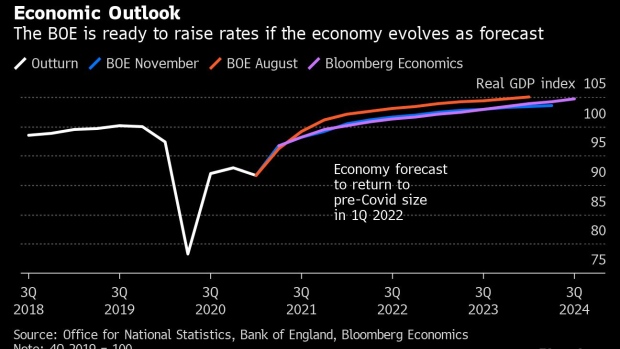

(Bloomberg) -- Bank of England Chief Economist Huw Pill said new variants of the coronavirus and the risk of another lockdown are some of the risks that could blow off track the view of policy makers that the U.K. economic recovery is maturing.

Speaking Friday as the emergence of the Nu variant of Covid-19 roiled global markets, Pill said the arrival of any new strain could disrupt the BOE’s guidance that rates have to rise in coming months.

“If there’s a financial disruption, or if there’s the onset again of a pandemic and a lockdown, those are the type of events which clearly would change our view of the world. We hope those things don’t happen, Pill told business leaders in northern England. “We hope those things don’t happen. We don’t really know what the future holds. It’s those unknown unknowns that the most difficult to manage.”

The remarks were meant to set out that the BOE’s main view is that policy makers will have to raise interest rates in the months ahead to keep inflation from overheating -- but risks remain to that outlook.

Pill said he’s reluctant to offer more precise guidance, citing a quote from the former heavyweight boxing champion Mike Tyson “who famously said everybody has a plan until you’re punched in the face.”

Markets scaled back bets on BOE action in the next few weeks, reflecting growing concerns the Nu variant could bring a new wave of infections and disrupt the global economic recovery. The chance of a hike in December is now seen at around 60%, after being almost fully priced last week.

Read more: Traders Unwind Rate-Hike Bets as New Covid Fears Spread

The comment from Pill introduced a small amount of doubt into an otherwise hawkish speech that dwelt on the strength of the U.K. recovery and signs that inflation is spreading. Pill hinted he’s ready to join the two policy makers who voted to raise rates to 0.25% last month, noting, “the ground has now been prepared for policy action.”

Seven members of the monetary policy committee voted to hold rates in November, but Pill suggested others are ready to move. He drew attention to the “somewhat unusual” guidance alongside the vote that “it will be necessary over coming months to increase Bank Rate in order to return CPI inflation to target.” He also said he was looking forward to the end of quantitative easing next month.

“I welcome the prospect of QE coming to an end. It has served its purpose,” he said. “ It remains part of our policy toolkit ... but the articulation of our stance for our policy decisions will be simplified and clarified by returning to a focus on Bank Rate.”

Pill added that the economy has continued to expand, that there has been no evidence of a spike in unemployment post-furlough and that little evidence of persistent above-trend wage growth or medium term inflation.

“The recovery is now well-established and even starting to mature,” he said. “It will be necessary over coming months to increase Bank Rate for the inflation target to be achieved in a sustainable manner.”

Although Pill said the increase in inflation would prove “transitory” it was not clear whether the spike would cause “the pernicious ‘second round effects’ that have long worried central bankers.”

He also pointed out that markets should not take policy makers’ statements too literally in future.

“Any guidance offered by monetary policy makers about the policy outlook always needs to be conditional on how circumstances evolve,” Pill said. “Given the often substantial uncertainty surrounding what the future holds, in general such guidance cannot amount to much.”

©2021 Bloomberg L.P.