Feb 18, 2019

Cracks Appear in High-Yield Valuations Even as Defaults Stay Low

, Bloomberg News

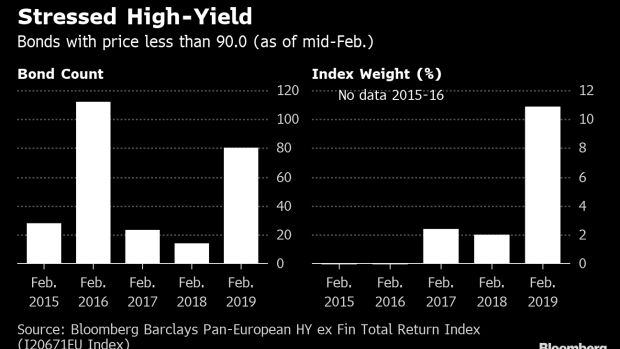

(Bloomberg) -- The number of corporate bonds in Europe falling into stressed or distressed territory has jumped this year despite a relatively benign outlook for speculative-grade default rates.

So-called “stressed” bonds, with a secondary price of less than 90, and those in distress, a price of less than 60, represent nearly 11 percent of the Bloomberg Barclays High Yield Index versus only 2 percent a year ago.

Secondary valuations continue to be weighed down by steep losses in the latter stages of 2018 and a primary market that has yet to gain momentum. The current mid-February tally of 80 stressed/distressed bonds is the highest since 2016, when a broad-based selloff gripped risk markets amid fears global growth was slowing.

--With assistance from Vinod Kumar Vemuri.

To contact the reporters on this story: Charles Daly in Stockholm at cdaly22@bloomberg.net;Laura Benitez in London at lbenitez1@bloomberg.net

To contact the editors responsible for this story: Sarah Husband at shusband@bloomberg.net, Charles Daly

©2019 Bloomberg L.P.