Mar 1, 2023

Credit ETFs Hammered by Record Outflows of Almost $12 Billion

, Bloomberg News

(Bloomberg) -- A dramatic repricing of the Federal Reserve’s interest-rate hiking path has spurred an unprecedented exodus from credit exchange-traded funds.

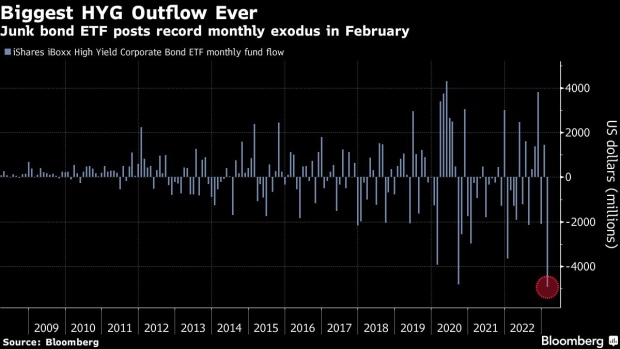

A trio of some of the most popular corporate bond ETFs posted a combined $11.9 billion in outflows last month, led by a record $4.9 billion withdrawal from the $12.8 billion iShares iBoxx High Yield Corporate Bond ETF (ticker HYG). The $33 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and the $7.4 billion SPDR Bloomberg High Yield Bond ETF (JNK) also posted their biggest monthly outflows ever, according to data compiled by Bloomberg.

Fixed-income markets of all stripes were rocked in February as investors recalibrated expectations for the Fed’s inflation fight. Stubborn inflation has fueled Treasury yields to multimonth highs, with traders bracing for the possibility that the central bank’s destination for rates will be higher than previously thought. Even still, spreads on both investment-grade and high-yield debt remain well below last year’s high — suggesting there will be more pain ahead.

“The two drivers of return — the risk-free rate and the spread — are both probably still too low for the environment we’re in, one where growth and inflation remain too hot and the Fed may have to go further,” Sameer Samana, Wells Fargo Investment Institute senior global market strategist, said. “So, the next meaningful move for spreads is probably higher.”

Markets are now priced for the Fed’s key rate to peak at roughly 5.5% in September, with some wagering that the benchmark interest rate will hit 6%. A month ago, traders were doubting that the central bank would reach 5% in its hiking campaign.

HYG and JNK both dropped about 2.4% in February amid the abrupt shift in mindset, the biggest monthly loss since December. Blue-chip debt fared worse, with LQD falling 4.5% in its worst showing since September.

While money drained from corporate bond ETFs, cash-like funds were in high demand. More than $4.5 billion flooded into the $24 billion iShares Short Treasury Bond ETF (ticker SHV) in February, the biggest monthly inflow in the fund’s 16-year history.

“What’s notably different this cycle is that cash and cash-like instruments are yielding anywhere from 4% to 5% plus,” Mona Mahajan, Edward Jones senior investment strategist, said on Bloomberg Television. “If investors do want to hang out, think about a recovery playbook but in the meanwhile put money in very attractively yielding assets, that’s a place where we’re seeing a lot of defense now.”

©2023 Bloomberg L.P.