Mar 22, 2023

Credit Risk Gauge Rises as Powell Rules Out Rate Cut This Year

, Bloomberg News

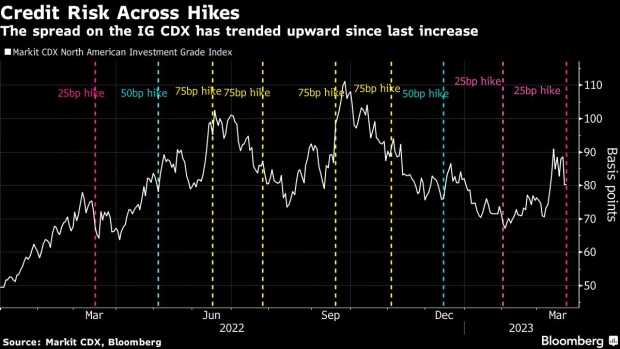

(Bloomberg) -- A measure of perceived risk in US corporate credit markets spiked Wednesday after Federal Reserve Chair Jerome Powell ruled out rate cuts this year and committed to the central bank’s goal of taming inflation.

The spread on the Markit CDX North America Investment Grade Index, which rises as credit risk increases, widened just over three basis points as of 4:33 p.m. New York time Wednesday. The index had tightened earlier this afternoon as the Fed delivered an expected hike, but Powell insisted that a rate cut this year was not the Fed’s “base case” and rates would go higher if necessary.

Treasury Secretary Janet Yellen also said that the government hasn’t considered wide-spread insurance on bank deposits as a solution to stabilizing the banking system, sending stocks lower.

Market participants have repriced their expectations dramatically this month following the failures of Silicon Valley Bank and the acquisition of Credit Suisse Group AG. On March 8, Fed fund futures had priced close to four more quarter point rate hikes by the end of the year, but as of Tuesday traders expected the Fed to begin cutting rates as soon as November.

Despite Powell’s insistence that the Fed will continue to raise rates if needed, traders doubled down Wednesday on bets that the Fed will cut rates this year.

“I actually do not think this was a tough call for the Fed. Both inflation and employment have firmed, but the banking woes caused them to expand the balance sheet by $300 billion and counting. They delivered the message they needed to; price stability is Fed enemy #1 long-term,” Scott Kimball, chief investment officer for Loop Capital Asset Management said.

Here’s what others are saying:

Nicholas Elfner, co-head of research at Breckinridge Capital Advisors

- “Twenty-Five it is and the Fed is one step closer to being done. But the rapid tightening cycle and Treasury curve inversion has go-forward implications for the economy, IG credit and spreads, which should weaken over time. Demand for recent non-Financials’ bond deals was solid since the market was starved of supply. Relatively high IG bond yields may continue to attract flows into the asset class.”

James Dichiaro, senior portfolio manager at Insight Investment

- “Very interesting initial reaction by the market. The Fed announces a 25 basis point rate hike and their statement makes reference to “some additional policy firming” as being appropriate yet front-end yields fall. This may imply that additional rate hikes will quickly need to be reversed as growth slows and we tip into recession. Should the economy meaningfully contract it likely leads to higher defaults within the leveraged finance space and wider credit spreads for investment grade issuers. It is clear that the Fed’s primary focus is bringing inflation closer to target despite the recent market volatility.”

Al Cattermole, portfolio manager at Mirabaud Asset Management

- “I think it was important for Fed credibility to do 25 basis points as inflation is still more sticky than the market assumed in January. No change in the terminal rate was dovish, given the hot inflation prints since December and the potential for the Fed to have moved closer to 6%, which likely reflects the impact of recent bank turmoil on their economic projections.”

--With assistance from Olivia Raimonde, Caleb Mutua, Josyana Joshua and Diana Li.

(Updates CDX move.)

©2023 Bloomberg L.P.