Oct 3, 2022

Credit Suisse market turmoil heightens after memo backfires

, Bloomberg News

Credit Suisse Board Split on Investment Bank Cuts

Credit Suisse Group AG was plunged into fresh market turmoil after Chief Executive Officer Ulrich Koerner’s attempts to reassure employees and investors backfired, adding to uncertainty surrounding the bank.

The stock, which had already more than halved this year before Monday’s sell-off, fell as much as 12 per cent to a record low before clawing back most of those losses and closing Zurich trading about 1 per cent lower. That was accompanied by a spike in the cost to insure the bank’s debt against default, which jumped to its highest ever.

Koerner, for the second time in as many weeks, had sought to calm employees and the markets with a memo late Friday stressing the bank’s liquidity and capital strength. Instead, it focused attention on the dramatic recent moves in the firm’s stock price and credit spreads, and investors rushed for the exit when trading reopened after the weekend. The shares staged a comeback as several analysts backed Koerner’s view of the bank’s financial strength.

While acknowledging that the bank was at a “critical moment,” Koerner pledged to send employees regular updates until the firm announces its new strategic plan on Oct. 27. At the same time, Credit Suisse again sent around talking points to executives dealing with clients who brought up the credit default swap, according to people with knowledge of the matter.

“Credit Suisse is a buy for the brave at these levels,” Citigroup analysts including Andrew Coombs wrote in a note to investors. “But headline news flow is likely to remain negative and we do see significant execution risk in any new strategic plan.”

While the swaps are still far from distressed -- and also part of a broad market selloff -- they signify deteriorating perceptions of creditworthiness for the scandal-hit bank in the current environment. The swaps now price in a roughly 23 per cent chance the bank defaults on its bonds within 5 years.

Some clients have used the rise in the CDS this year to ask questions, negotiate prices or use competitors, the people said, asking to remain anonymous discussing confidential conversations.

A Credit Suisse spokesman declined to comment.

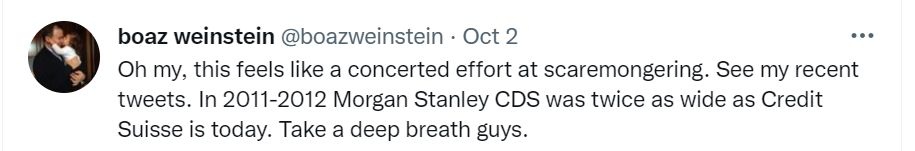

Still, prominent figures took to Twitter over the weekend to dismiss some of the rumors circulating on social media prompted by the widened CDS spread as “scaremongering.” Saba Capital Management’s Boaz Weinstein tweeted “take a deep breath” and compared the situation to when Morgan Stanley’s CDS was twice as wide in 2011 and 2012.

Koerner, named CEO in late July, has had to deal with market speculation, banker exits and capital doubts as he seeks to set a path forward for the troubled lender, which has been hit by a string of financial and reputational hits. The firm is finalizing plans that will likely see sweeping changes to its investment bank and may include cutting thousands of jobs over a number of years, Bloomberg has reported.

Analysts at KBW also estimates that the bank may need to raise 4 billion Swiss francs (US$4 billion) of capital even after selling some assets to fund any restructuring, growth efforts and any unknowns.

Credit Suisse’s market capitalization has dropped to around 10.4 billion Swiss francs, meaning any share sale would be highly dilutive to longtime holders. The market value was above 30 billion francs as recently as March 2021.

“Somehow they have to come up with a few billion to cover the cost of the restructuring,” said Andreas Venditti, a banks analyst at Vontobel. “Management will try at all costs to avoid a dilutive share issuance but they are a forced seller right now.”

Bank executives have noted that the firm’s 13.5 per cent CET1 capital ratio at June 30 was in the middle of the planned range of 13 per cent to 14 per cent for 2022. The firm’s 2021 annual report said that its international regulatory minimum ratio was 8 per cent, while Swiss authorities required a higher level of about 10 per cent.

Regulators in both the UK and Switzerland, who have been keeping a close eye on Credit Suisse since the multibillion-dollar Archegos Capital loss in 2021, continue to monitor the bank’s stability, according to people with knowledge of the matter.

Spokespeople for the UK’S Prudential Regulation Authority and Switzerland’s Finma declined to comment.

The KBW analysts were the latest to draw comparisons to the crisis of confidence that shook Deutsche Bank AG six years ago. Then, the German lender was facing broad questions about its strategy as well as near-term concerns about the cost of a settlement to end a US probe related to mortgage-backed securities. Deutsche Bank saw its credit-default swaps climb, its debt rating downgraded and some clients step back from working with it.

The stress eased over several months as the German firm settled for a lower figure than many feared, raised about 8 billion euros (US$7.8 billion) of new capital and announced a strategy revamp. Still, what the bank called a “vicious circle” of declining revenue and rising funding costs took years to reverse.

There are differences between the two situations. Credit Suisse doesn’t face any one issue on the scale of Deutsche Bank’s US$7.2 billion settlement, and its key capital ratio of 13.5 per cent is higher than the 10.8 per cent that the German firm had six years ago.

The stress Deutsche Bank faced in 2016 resulted in the unusual dynamic where the cost of insuring against losses on the lender’s debt for one year surpassed that of protection for five years. Credit Suisse’s one-year swaps are still significantly cheaper than five-year ones.

Last week, Credit Suisse said it’s working on possible asset and business sales as part of its strategic plan which will be unveiled at the end of October. The bank is exploring deals to sell its securitized products trading unit, is weighing the sale of its Latin American wealth management operations excluding Brazil, and is considering reviving the First Boston brand name, Bloomberg has reported.

The bank today also decided to postpone its capital increase for a real estate fund amid high volatility in the market. The postponement echoes a challenging period a year ago after the Greensill and Archegos scandals whereby the bank slowed down new fund issuance as it reigned in risk appetite.