Feb 9, 2022

Credito Real Defaults After Bid to Raise Cash Falls Short

, Bloomberg News

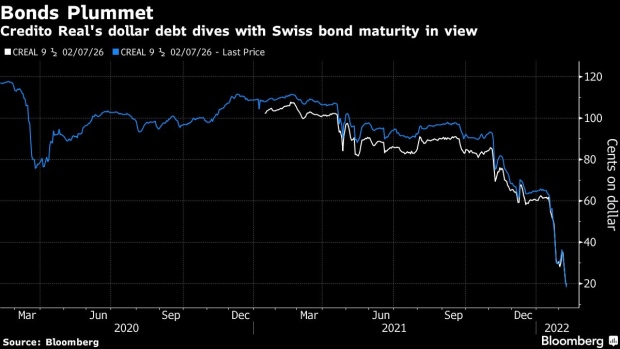

(Bloomberg) -- Credito Real SAB was declared in default by Fitch Ratings after the Mexican payroll lender failed to come up with the cash to pay off a maturing bond.

The troubled company had said earlier in the day that it wasn’t able to secure a loan that would have allowed it to refinance the debt, a 170 million Swiss franc ($184 million) note. It hired DLA Piper and FTI Consulting to help evaluate restructuring options.

Credito Real’s default caps a swift downfall for a financial firm that had been a market darling for the past decade, and comes just six months after a bankruptcy filing from rival Alpha Holding SA. The companies’ troubles have cast a harsh light on an industry that relied on issuing small loans -- and charging double-digit interest rates -- to the millions of traditionally unbanked across the country.

The missed payment may trigger cross-default clauses on some of Credito Real’s other obligations, Fitch said in a statement. The company had just $80 million of cash on hand at the end of the third quarter, and has overseas bonds totaling almost $2 billion, according to data compiled by Bloomberg.

“Ongoing negotiation did not end on a timely payment, and the entity has not publicly articulated if the previous plans and funding in process remain unchanged after the missed payment,” Fitch analysts Bertha Perez Wilson and Marcela Galicia wrote.

The company and its advisers are engaging with investors to evaluate “all strategic alternatives,” Credito Real said in an earlier statement.

Doubts about the sector surfaced late last year after Alpha Holding disclosed a $200 million accounting error and Credito Real followed with a revelation of its own, namely that non-performing loans were about 82% higher than disclosed in an earlier filing.

The company’s dollar-denominated bonds due in 2028 slumped 6 cents to about 15 cents on the dollar. Shares tumbled 28% to a record low, down 95% from a peak reached in late 2015.

S&P Global Ratings and Fitch slashed Credito Real deeper into junk territory last week, warning of the growing risk of default.

Credito Real is owned by the family that controls home-appliance manufacturer Controladora Mabe SA. It created the company from what had been a small financing operation that provided loans to customers who bought Mabe goods.

Now Credito Real focuses on payroll loans, with a smaller portion of its business tied to small- and medium-sized businesses, as well as microfinance and car loans in the U.S.

Credito Real’s board voted to replace five members and include more independent directors Wednesday as it worked to come up with the money, according to a person familiar with the decision.

The move followed a yearlong push by the board’s president, Angel Francisco Romanos Berrondo, to add more professional supervision at the company that was founded by his family, according to the person, who asked not to be identified discussing private information. It follows criticism that too many family members were serving as directors, the person said.

The five members who resigned included three from the controlling Berrondo family and two independents. They were set to be replaced by four independent members as well as another director connected to the family, leaving the board with five independent members and four tied to the controlling shareholders, the person said.

Credito Real’s default will have ripple effects across Mexico’s non-bank consumer financing industry, according to Omotunde Lawal, head of emerging-market corporate debt at Barings UK Ltd. in London.

“Recoveries will be difficult until a clear picture of valuation of loan portfolios emerges and other creditor obligations are clearer,” she said.

©2022 Bloomberg L.P.