Bank of Canada Sees Gradual Pace of Rate Cuts to Balance Risks

Bank of Canada officials said monetary policy easing is expected to be “gradual,” as they debate the timing of a pivot to rate cuts.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Bank of Canada officials said monetary policy easing is expected to be “gradual,” as they debate the timing of a pivot to rate cuts.

Recovering risk appetite and tightening spreads in the commercial real estate market mean active managers have to work a little harder, according to DoubleLine Capital LP.

Iceland’s inflation eased to the slowest pace in more than two years, suggesting its central bank is more likely to begin reducing the western Europe’s highest interest rate in the coming months.

The UK housing market recovery is threatened by investors scaling back bets on how far the Bank of England will cut interest rates, according to a new report.

US mortgage rates increased to the highest level in five months, pushing down home-purchase applications for the fifth time in the last six weeks.

Sep 28, 2021

, Bloomberg News

(Bloomberg) -- Some holders of a bond issued by a company called Jumbo Fortune Enterprises are forming a committee to press their claims in the event of a default because they maintain China Evergrande Group is a guarantor of the debt, according to people familiar with the plans.

The $260 million note from Jumbo Fortune Enterprises matures Oct. 3, according to data compiled by Bloomberg. The dollar note is guaranteed by China Evergrande Group and its unit Tianji Holding Ltd., people familiar with the matter said, asking not to be identified because the details are private.

Jumbo Fortune is a joint venture whose owners include Hengda Real Estate, Evergrande’s main onshore unit, according to a local bond prospectus published in April by Hengda. As Oct. 3 is a Sunday, the effective due date is the following day.

The deadline is perhaps Evergrande’s largest debt test since regulators recently urged the company to avoid defaulting on dollar bonds. The world’s most indebted developer and biggest issuer of junk bonds in Asia sparked fears of contagion across global financial markets in recent weeks.

It’s already fallen behind on payments to banks, suppliers and holders of onshore investment products. The builder faces a $45 million coupon on Sept. 29 for a dollar bond that matures 2024, after giving no sign last week of having met a separate $83.5 million coupon payment on other securities.

A representative from Evergrande didn’t immediately respond to a request for comment on the bond guarantee terms and repayment plan. The general line at Hengda went unanswered Tuesday.

The guarantees from Evergrande and Tianji Holding constitute direct, unconditional and unsubordinated obligations and rank on at least on an equal footing with the other unconditional and unsubordinated obligations of the guarantors, according to the people.

Five business days would be allowed if any failure to pay were due to administrative or technical error, though beyond that there would be no grace period, the people said.

The security is not listed on exchanges, according to the Bloomberg-compiled data. Bonds without such listings that were issued to pre-selected buyers rather than through a public offering are sometimes called private placements.

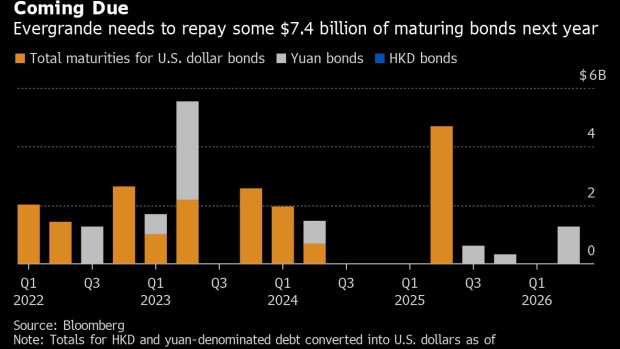

Evergrande’s next major public note to mature will be in March, part of $7.4 billion of securities due in 2022. Here’s the maturity schedule for those offshore and local notes issued by Evergrande and its units that come due next year, according to data compiled by Bloomberg:

©2021 Bloomberg L.P.