Jan 26, 2020

Crop Futures Slump as Spreading Virus Threatens Chinese Demand

, Bloomberg News

(Bloomberg) -- Crop futures traded in Chicago sank as China’s death toll from the coronavirus surged amid government reports that the infection was spreading more quickly, threatening demand in the world’s largest consumer of agricultural commodities and the biggest soybean importer.

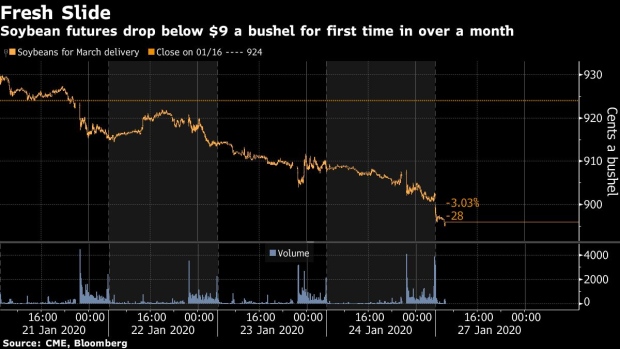

Soybeans dropped below $9 a bushel for the first time since early December and have lost more than 6% this month. Corn was down over 1% and wheat fell 2% as selling gripped global financial markets in a deepening risk-off mood.

The lockdown on movement and travel in many areas in China and the preference among the country’s people to stay at home while the outbreak rages rather than eat at restaurants, looks set to hammer demand in a nation already ravaged by African swine fever, which has slashed hog herds, and reduced consumption of livestock feed, such as soybean and rapeseed meal.

China is the world’s top producer and consumer of rice and wheat, and the second biggest for corn. The proliferation of the virus, the hit to demand and the disruption of transport and the economy add another blow to agricultural markets hoping for more Chinese purchases of American farm products after the signing of the U.S. trade deal earlier this month.

Chinese authorities on Sunday said the virus isn’t yet under control despite aggressive steps to limit movement for millions of people who live in cities near the center of the outbreak. The country extended the Lunar New Year break until Feb. 2 from Jan. 30 originally.

To contact the reporter on this story: James Poole in Singapore at jpoole4@bloomberg.net

To contact the editor responsible for this story: Anna Kitanaka at akitanaka@bloomberg.net

©2020 Bloomberg L.P.