Jun 15, 2022

Crypto Altcoins Pop as Post-Fed Rally Sweeps Across Risk Assets

, Bloomberg News

(Bloomberg) -- Wednesday brought at least one positive development in the beaten-down crypto space: Alternative digital currencies posted big rallies as all manner of riskier assets bounced following the Federal Reserve’s June policy decision.

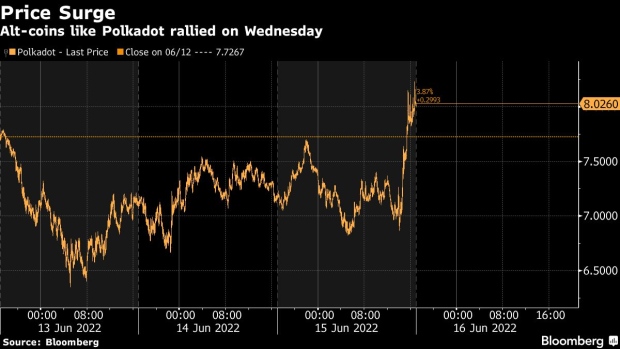

So-called alts, which are smaller and sometimes lesser-known coins, surged as US stocks rallied on comments from the central bank’s chief that super-aggressive interest-rate hikes might not necessarily be in the cards going forward, even as the Fed intensifies its fight against inflation. Cardano, Solana and Dogecoin each added more than 6% late Wednesday in New York, and Polkadot gained as much as 15%. Bitcoin and Ether, meanwhile, ended the day flat.

Fed policy makers raised interest rates by 75 basis points, the biggest hike since 1994, and signaled that there won’t necessarily be a string of similar increases coming down the line, though it could happen again. The S&P 500 closed 1.5% higher, its first positive session in six. The Nasdaq 100 bounced 2.5%.

Though the losses in the crypto space over the past month have been tough to stomach, many have been welcoming of the wring-out of excesses and sky-high speculation.

“The reality is we need to see capitulation where that ‘noobishness’ gets washed out,” said Max Gokhman, chief investment officer for AlphaTrAI. “One issue with a community built on convoluted white papers on one end and dank memes on the other is the nuance of things like monetary policy affecting how much fiat goes into digital gets lost,” he said, adding that “we need to see the asset class evolve to a more mature state, and I think it’s in the process of doing that.”

Crypto started sliding late last year on expectations of a less accommodative Fed, with rising interest rates hurting the industry and its prospects. Last month’s collapse of the Terra blockchain and the recent decision by crypto lender Celsius Network Ltd. to halt withdrawals have also taken a toll, while a tweet this week from the co-founder of crypto hedge fund Three Arrows Capital fueled speculation that it had suffered large losses. Even long-term holders who have avoided selling until now are coming under pressure, according to researcher Glassnode.

All sorts of pockets within the space have been beset by negative developments amid the drawdown that’s wiped out hundreds of billions in value. A number of crypto firms have announced layoffs and hiring freezes, and many market-watchers are expecting further price declines ahead.

“Crypto is a risk asset. It’s an expression of people taking where they are on the risk spectrum, whether they’re playing more risk-averse or if they’re playing more risk-seeking,” Anna Han of Wells Fargo Securities LLC said in an interview.

Meanwhile, Michael Purves, founder and CEO of Tallbacken Capital, sees further declines ahead, at least for Bitcoin. “We continue to think that Bitcoin’s broader picture is bearish, and perhaps our $15k target is not bearish enough,” he wrote in a note. “Nonetheless, for the near term, we recommend taking profits on short positions.”

©2022 Bloomberg L.P.