Mar 8, 2022

Crypto Lobbying Skyrocketed Last Year and Quadrupled Since 2018

, Bloomberg News

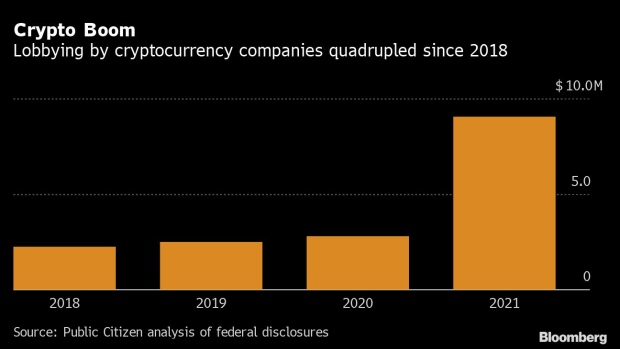

(Bloomberg) -- The business of influencing cryptocurrency policy in Washington exploded last year and has more than quadrupled in the past four years, according to a new study.

Since 2018, spending on crypto lobbying has quadrupled, according to a Public Citizen analysis of federal disclosures. The number of lobbyists working on crypto issues also climbed to 320 from 115 in the same period.

In total, the industry spent more than $9 million attempting to influence members of Congress in 2021, according to the report. Marquee spenders included Coinbase Global Inc, Ripple Labs Inc., and the Blockchain Association, which together made up over a third of lobbying by crypto companies in 2021.

While this is a fraction of what the technology sector or the investment industry spends attempting to reach their policy goals each year, it’s a meteoric rise for a still-nascent industry, wrote Public Citizen’s Rick Claypool in a report released Wednesday.

Spending by crypto firms alone doesn’t capture the breadth of business interest in digital asset policy. Corporations such as International Business Machines Corp., Fidelity Investments, and Meta Platforms Inc. disclosed lobbying on crypto-related topics in 2021.

Traditional financial and business trade associations were also active. The nation’s largest business lobby, the U.S. Chamber of Commerce, listed 32 lobbyists on digital asset issues, according to the report. The National Venture Capital Association listed 24.

The report also warns of a revolving door between government and the cryptocurrency sector, pointing to several high-profile officials who’ve joined the industry. Blanche Lincoln, a former Democratic Senator from Arkansas, lobbied for the Blockchain Association. President Trump’s former Deputy Chief of Staff, Rick Dearborn, represented the Stellar Development Foundation.

Read More: Crypto Masters Washington’s ‘Revolving Door’ as Influence Grows

The Chamber of Digital Commerce lists former Securities and Exchange Commissioner Paul Atkins, former Acting White House Chief of Staff Mick Mulvaney, and Christopher Giancarlo (known by some as #CryptoDad), who is a former chairman of the Commodities Futures Trading Commission, on its Board of Advisors.

This boom in spending and hires is a “characteristic response of an expanding industry drawing regulatory and legislative scrutiny,” writes Claypool. “The cryptocurrency lobbying spree is only just beginning.”

©2022 Bloomberg L.P.