May 12, 2022

Crypto-Market Panic Subsides With Prices, Tether Stabilizing

, Bloomberg News

(Bloomberg) -- On Wednesday, the implosion of the TerraUSD stablecoin kindled wide-spread panic in the crypto space. But 24 hours later, things have calmed down significantly.

Terraform Labs halted its Terra blockchain to limit damage in the wake of the collapse of TerraUSD and its related Luna token. Tether, the largest stablecoin used in cryptocurrency markets to facilitate trading, recovered from a mini-crash, soothing frayed trader nerves that its troubles might spill into the broader market. Tokens underpinning key decentralized finance protocols also advanced, with Avalanche adding 12% as of 12:17 p.m. in New York, according to Bloomberg data.

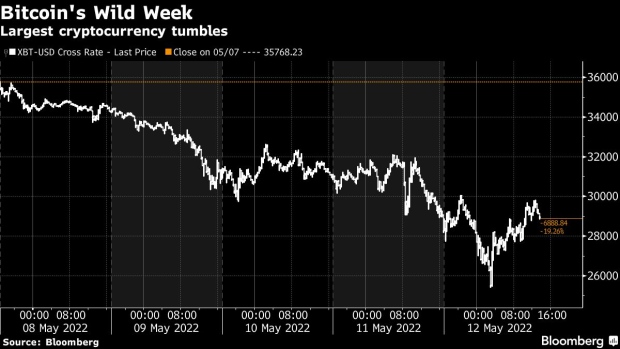

Bitcoin, meanwhile, rose as much as 6% to trade around $30,000, after falling to about $25,000 overnight. And some alternative coins also gained, with Bitcoin Cash adding 20%.

It’s a remarkably more positive picture from the havoc that overtook crypto markets on Wednesday amid a downward spiral in the TerraUSD stablecoin. Just a day prior, devastation had gripped markets, with Bitcoin suffering a nearly 10% drop at one point.

“The fact that Tether is stabilizing means that the margin calls that took place are fading,” said Matt Maley, chief market strategist at Miller Tabak + Co. “Whenever you get forced selling in anything, it overshoots. People are still nervous, but the selling has abated. Investors will be nervous for a few more days, but the supply-demand equation has stabilized again.”

Market-watchers noted that Bitcoin, which typically trades in tandem with the stock market, was able to gain on Thursday even as the S&P 500 and Nasdaq 100 sunk. Treasury Secretary Janet Yellen, meanwhile, said Terra’s tumble showed the dangers of tokens that purport to be pegged to the US dollar, though she added that its implosion didn’t pose a threat to financial stability.

“Crypto has little economic significance. Not that many people own much of it,” said Brian Nick, chief investment strategist at Nuveen. Still, he added that the crypto market is being swayed by the same forces that are affecting equities right now.

“What gets punished when financial conditions are tightening? Anything with a high valuation and an uncertain or non-existent revenue stream,” he said by phone. “And crypto has inarguably high valuations and no revenue stream. That’s very much of a piece with what we’re seeing in growth stocks, tech. It’s correlated but obviously it’s more volatile because the market is less liquid.”

Read more: Yellen Says Terra Meltdown Shows Crypto-Stablecoin Dangers

Read more: Terra Developers Halt New Transactions on Stablecoin Blockchain

Various trading desks reported business-as-usual conditions, with B2C2 saying it saw two-way flows into UST, and more buying in USDC. Stephane Ouellette, chief executive of FRNT Financial Inc., said he’d received questions about Tether, with clients wondering if its dislocation provided any arbitrage opportunities.

“Last night there was a huge arb,” he said, adding that “everything at Tether and Bitfinex appears to be working as usual.”

“There’s no indication there’s anything going wrong there at all besides the market move, which is now looking like it was circumstantial,” he said.

©2022 Bloomberg L.P.