Sep 14, 2022

Crypto Markets Brace for Historic Upgrade of Ethereum Blockchain

, Bloomberg News

(Bloomberg) -- Cryptocurrencies traded in relatively tight ranges Thursday as Ethereum, the most commercially important blockchain in the digital-asset sector, underwent a major software upgrade.

The price of Ether jumped to an intraday high of $1,654 shortly after the Merge completed on Thursday, but was down 0.6% as of 12:34 p.m. in London. Bitcoin was up 1.2%. Fairly calm conditions were also evident for coins such as Cardano and Solana.

Ethereum’s revamp -- known as the Merge -- makes it vastly more energy efficient and paves the way for it to scale up and become quicker, according to the network’s developers. The update was years in the making and appears to have gone smoothly so far, though hiccups remain possible.

“For institutional investors, ones who are ESG conscious, they will use this as an opportunity to dip their toes into blockchain, into tokens, into Ethereum,” Teong Hng, co-founder at digital-asset platform Satori Research, said on Bloomberg Television.

Exchanges and lending platforms temporarily disabled Ethereum-related services before the Merge. They later began bringing them back online.

There were indications of substantial Ether inflows into exchanges ahead of the Merge. The exact reasons why were unclear.

Inflows

Alex Svanevik, co-founder and chief executive officer of blockchain research portal Nansen, in a Twitter post cited $1.2 billion of inflows into separate exchanges in two transactions.

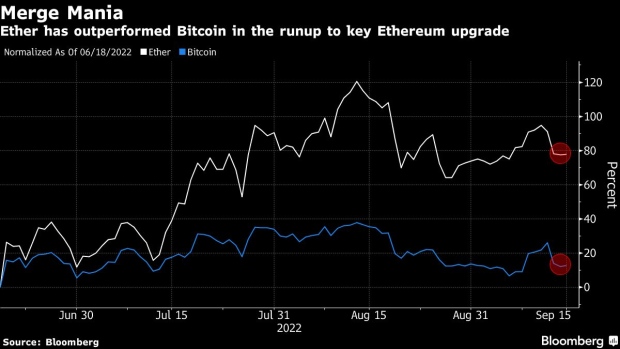

Ether has climbed about 80% since a mid-June low, far outstripping Bitcoin, partly on Merge hype, though that rally is now cooling.

Both Bitcoin and Ether are down more than 50% in 2022, hurt by rising interest rates that sucked liquidity from global markets.

The medium and longer term Ether outlook is brighter, according to Stefan Rust, chief executive of blockchain development house Laguna Labs.

In a note, he said Ether could top $3,000 by the end of this year and possibly achieve the so-called “flippening” in time, referring to the idea that its market value might overtake Bitcoin’s.

(Updates prices in third paragraph)

©2022 Bloomberg L.P.