May 26, 2022

Crypto Needs Urgent EU Rulebook to Protect Investors, Regulator Says

, Bloomberg News

(Bloomberg) -- Europe’s top securities regulator has warned that soaring inflation may drive retail investors into risky cryptoassets and called for a formal legal framework to govern the industry across the bloc.

Verena Ross, chair of the European Securities and Markets Authority, said she was waiting “with great impatience” for the EU’s blueprint for regulation of the area to be finalized as a law.

“With inflation rising, investors will look to find investments which are able to try to compensate for inflation and bring greater returns, which might lead to greater risk taking,” Ross said in an interview on Wednesday. “That is something we are monitoring very closely.”

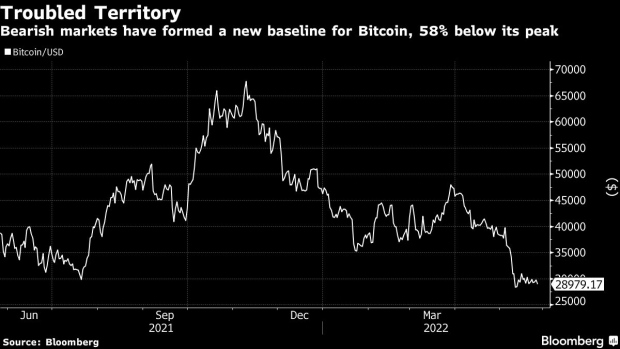

Regulators are intensifying their pressure on crypto amid choppy action in the market, with Bitcoin down 58% and Ether down 62% from their November highs. The European Central Bank has stepped up calls for tighter regulation after the stablecoin TerraUSD tumbled from its intended dollar peg earlier this month.

For now, national regulators in the European Union base their crypto decisions on local laws, with individual countries taking different approaches. Binance Holdings Ltd., the world’s largest cryptocurrency exchange by trading volume, secured regulatory approval from the French government earlier this month, boosting its operational plans across Europe. It has also been courting the German financial regulator.

“There is no EU regulatory framework for these kinds of entities at the moment and so there is currently an imbalance in how national supervisors deal with these entities and how they judge them,” Ross said. “That’s where a common regulatory framework will help.”

A draft framework, the Markets in Crypto-Assets Regulation -- or “MiCA”, was first proposed in September 2020 as a way to standardize crypto regulation in the EU. It is currently being examined by the European Parliament and Council. Ross said she hoped that process would be finalized in the coming months and that the law would be in place in 2023 or 2024.

ECB President Christine Lagarde said last week that in her view crypto is “worth nothing.” Governing Council member Francois Villeroy de Galhau added to the skepticism on Monday saying that the promises of rewards in crypto were “an illusion.”

Binance supports a “stable regulatory environment,” a spokesperson said. “A consistent set of regulations implemented across Europe would be beneficial to everyone and MiCA has the potential to be foundational in establishing Europe at the forefront of this new industry.”

Christian Faes, who is chair of the industry group Fintech Founders and is setting up a Bitcoin investment vehicle in the US, said a harmonized regulatory approach -- rather than a country by country one -- could help the industry develop.

“I understand that each country is trying to lay out its own stall -- I would just be suspicious about it being aimed more at trying to thwart the growth of crypto rather than being open-minded to the potential benefits,” Faes said.

While concerns among regulators and policymakers are growing about the danger cryptoassets could pose to individuals who do not understand the risks and cannot afford potential large losses, others argue that the trend is benign so far. Ian Taylor, head of crypto and digital assets team at KPMG UK, said there is no firm evidence that consumers are flooding into crypto assets because of high inflation.

©2022 Bloomberg L.P.