Apr 11, 2022

Crypto Oligopoly Imminent as Top Exchanges Grab 96% Market Share

, Bloomberg News

(Bloomberg) -- Top-tier crypto exchanges reached an all-time high market share this year as traders sought lower-risk venues amid broader market volatility, data compiled by tracker CryptoCompare show.

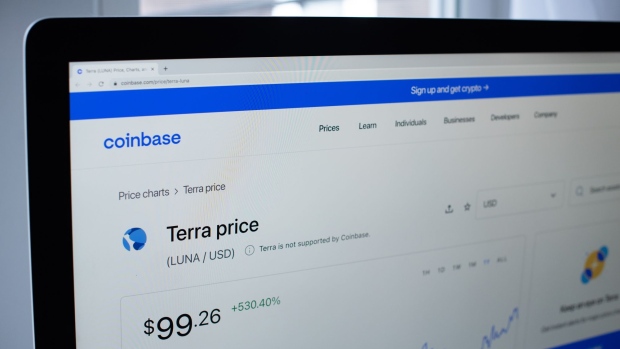

Crypto exchanges considered top level increased their market share to 96% in February from 89% in August, according to the tracker. These 78 exchanges, led by Coinbase Global Inc., Gemini Trust Co., Bitstamp Ltd. and Binance, have grabbed market share from peers that have struggled to maintain security and stability.

Top-ranked exchanges traded a total of $1.5 trillion in February. So-called lower-tier exchanges traded roughly $62 billion that month, CryptoCompare said in a report published Monday.

The researcher graded 150 spot exchanges based on everything from legal and regulatory compliance to security to whether they check their customers’ identities and had been compromised in the past.

More than 50 exchanges have shut since June 2019 as China cracked down on its crypto industry and traders fled to better-quality venues, the report said. An acquisition spree by top crypto exchanges has also led to further consolidation. Gemini, the cryptocurrency platform run by the Winklevoss brothers, acquired trading technology provider Omniex earlier this year to better serve institutional investors. FTX Trading Ltd. too announced its acquisition of fintech Liquid Group to increase its presence in Japan.

“As the industry matures, we expect there to be an oligopoly of exchanges dominating trading volumes as their traction accelerates and smaller players are left behind,” CryptoCompare said in the report.

Lower-ranked exchanges can have a slew of problems, the report said. More than a third of all crypto exchanges have poor or inadequate know-your-customer programs. And 3% don’t reveal the legal entities associated with them while only 11% offer some form of crypto insurance, according to CryptoCompare.

©2022 Bloomberg L.P.