Sep 24, 2021

Crypto's 'peak FUD' moment arrives as hammer drops in China

, Bloomberg News

China crackdown on crypto may just be cautionary due to Evergrande's debt crisis: Coinberry CEO

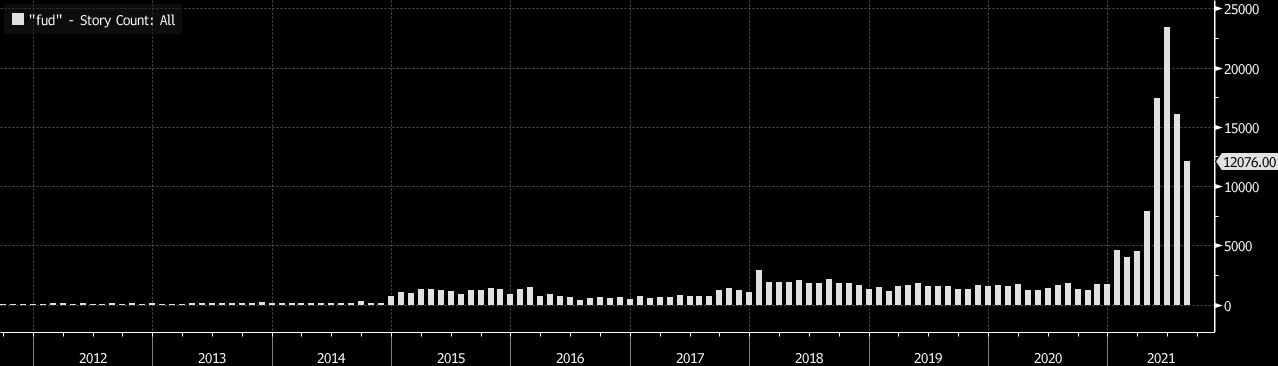

Among the countless pieces of technical jargon and acronyms that the cryptocurrency community throws around, there’s one important concept that’s easy to understand even for the liberal-arts majors among us: FUD.

That stands for “Fear, Uncertainty and Doubt” and it’s sort of a catch-all pejorative used to dismiss the seemingly never-ending list of concerns and criticisms that perpetually dog the digital-asset class even as it continues to grow at a breathtaking pace.

It all started with Bitcoin’s reputation as the currency of choice for drug traffickers, money launderers, tax cheats and malware ransomists. Upon that foundation, a skyscraper of FUD has been erected that now contains concerns about crypto’s rapacious energy use and even its potential to spread contagion to the traditional financial system as the dollar value of tokenized assets grows into the trillions.

Of course, potentially the biggest threat is the fear, uncertainty and doubt about what governments around the world will do about it all. As a result, China’s decision to ban all crypto transactions and mining, coupled with intensifying scrutiny of blockchain assets by the Securities and Exchange Commission and other U.S. regulators, is creating a peak FUD moment for crypto.

Yet, the remarkable thing is that -- like the proverbial “wall of worry” that never seems to hurt the stock market -- growing FUD never seems to do much damage to the value of crypto assets. At least, not for long. Yes, Bitcoin is down 5 per cent following China’s latest ban on all crypto transactions and vow to root out mining of digital assets, but that’s just another day in the virtual office for this volatile asset class. Bitcoin and other coins actually were hit harder earlier this week when concerns over China Evergrande Group spread throughout all manner of global markets.

“If the regulators look at something unfavorably, there’s a contingent of crypto investors who say, ‘That makes me like that more, not less,’” said Stephane Ouellette, CEO and co-founder of FRNT Financial Inc., a crypto-focused capital-markets platform. That’s “because of the anti-establishment mentality that crypto was born out of.”

There’s also a bit of a Chicken Little element to the spread of FUD -- so many past purported threats to the asset class never quite came to fruition.

Last month, the FUD centered around the U.S. infrastructure bill in Congress that contained mandates on tax compliance for cryptocurrency brokerages. Yet it didn’t do much to dent the bullish sentiment within the crypto-community, with Bitcoin, Ether and others continuing to rally. Newer coins like Cardano and Solana more than doubled. August volumes on Binance, the world’s largest crypto exchange, jumped 65 per cent in the month and open interest in Ethereum futures and perpetual futures jumped 41 per cent, according to researcher CryptoCompare.

A website called 99Bitcoins.com tracks what it considers to be “Bitcoin obituaries,” or hot takes declaring the token to be worthless by writers and websites with significant audiences. Bitcoin has died 430 times, according to their tally.

“The bad news isn’t unexpected -- it comes with all sorts of new technologies,” said Zack Voell, director of research at Compass Mining. “But I expect it to dissipate and shed some of its regularity as crypto becomes increasingly more mainstream and more widely understood.”

For Sam Bankman-Fried, chief executive officer of exchange FTX, a lot of the FUD-filled headlines these days don’t necessarily represent a more negative period for crypto. “There’s just a lot more attention focused on it and particularly a lot more attention focused on trying to set apart the negatives in the industry,” he said.

When it comes to actions by governments, the consensus among the industry’s players tends to be that regulations may change the way participants in the market conduct transactions -- but any news of the asset class’s demise is greatly exaggerated.

As Brian Mosoff, CEO of Canadian crypto-investment firm Ether Capital Corp., put it: “You can’t regulate at the protocol level, meaning you can’t change the code of Bitcoin.”

“I don’t think it matters that much what regulators do,” he said during an interview on Bloomberg’s “What Goes Up” podcast. “It’ll change how people interact with these assets and how they interact from specific jurisdictions. But I don’t think the assets themselves are going to just disappear overnight,” he added. “What’s going to get regulated here are the access points and the marketplaces.”

Still, to Art Hogan, chief strategist at National Securities, there could be a “whistling past the graveyard” mentality in place as crypto investors ignore what may end up being a major sea change when it comes to regulatory scrutiny.

“It just hasn’t settled in yet,” he said. “But that likely changes pretty abruptly. And cryptocurrencies tend to have abrupt moves. They’re never calm, they’re never steady. It’s either a volatile move higher -- and oftentimes followed by volatile moves lower.”

One thing that’s for sure is that the stakes are growing higher, as more and more big-money investors from traditional markets -- like hedge-fund billionaire Steve Cohen -- get converted into crypto true believers.

Another luminary of the hedge fund world, Ray Dalio of Bridgewater Associates, weighed in on Bitcoin this week on Bloomberg TV, calling it a “tremendous accomplishment” from a technology perspective. Of course, even that praise was dripping with FUD.

If “successful, there’s the risk the government will outlaw it,” he said.