Nov 17, 2022

Crypto Stocks’ Rout Delivers $469 Million Win to Short Sellers

, Bloomberg News

(Bloomberg) -- The fallout for publicly-traded companies exposed to cryptocurrencies has been a boon for investors betting against them, delivering roughly $469 million in paper profits for November alone.

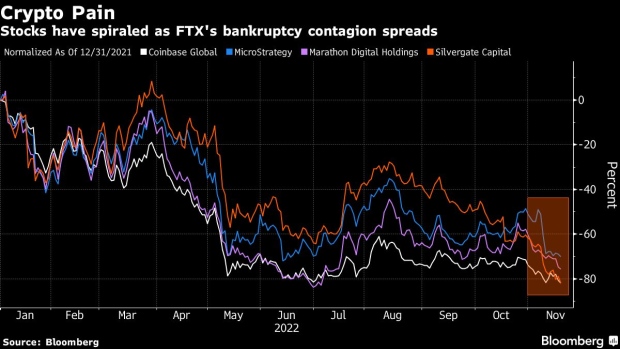

MicroStrategy Inc. is down 37% this month through Wednesday’s close, handing shorts $286 million in mark-to-market profits, while Coinbase Global Inc.’s 26% decline delivered another $229 million in gains, according to financial analytics firm S3 Partners. Huge losses for other peers, including Marathon Digital Holdings Inc. and Silvergate Capital Corp., have helped drive profits in November for investors betting against the industry through short sales, Ihor Dusaniwsky, S3’s managing director of predictive analytics, wrote in a note.

The group of stocks has tumbled as investors weigh how far reaching the fallout from the collapse of Sam Bankman-Fried’s FTX Group will be across the cryptocurrency ecosystem. Contagion from FTX’s bankruptcy has forced management teams to attempt to distance themselves from the company, with exposed stocks following tokens, including Bitcoin, lower. The largest cryptocurrency by market value has fallen nearly 20% so far this month, compared with a 1.1% gain for the S&P 500 Index.

“We expect increased short selling in these stocks as the possibility for broader sector wide price weakness increases,” Dusaniwsky wrote. With the underlying cryptocurrency market in temporary disarray, he expects shorting activity to “see-saw between shorting and covering as momentum trading overtakes fundamental investing in these stocks.”

Skeptics have added to bearish bets over the past week, driving almost $93 million of new short selling, according to S3 data. More than one-quarter of MicroStrategy shares available for trading are currently sold short, while Marathon Digital, Bakkt Holdings Inc. and Coinbase each have short interest levels above 15% of the shares available for trading, the data show.

Despite the industry fallout, Cathie Wood’s funds have continued to pile onto bets in Coinbase, Silvergate Capital and Grayscale Bitcoin Trust. Funds run by Wood’s Ark Investment Management have been on wild rides this year as growth stocks have been battered by Federal Reserve interest rate hikes and fears of a recession.

©2022 Bloomberg L.P.