Jun 10, 2022

Crypto Washout Sends Major Coins to Lowest Levels of the Year

, Bloomberg News

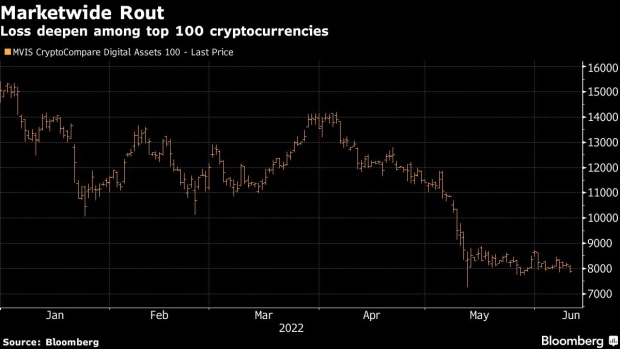

(Bloomberg) -- Losses in cryptocurrencies deepened Friday, with everything from Bitcoin to Ether to Solana either setting or approaching their lowest levels of the year.

The MVIS CryptoCompare Digital Assets 100 Index, a market cap-weighted measure which tracks the performance of the 100 largest tokens, declined 4.9%, bringing the drawdown for the year to almost 50%. Bitcoin, which accounts for almost half the index, slumped for a fourth day. Ether, which makes up about 18%, breached an earlier low set at the start of May after the collapse of the Terra blockchain. Popular DeFi tokens such as Solana and Cardano fell even more.

“We are entering into a crypto winter,” said Paul Veradittakit, a partner at Pantera Capital Management. “Capital is going to consolidate with the larger cap coins like BTC and ETH for the time being.”

Investors are increasingly saying the market is in the midst of crypto winter, as extended period of declines have become known over the years. Last week, Gemini Trust, run by the Winklevoss brothers, laid off 10% of employees citing worsening market conditions. Coinbase Global Inc., the biggest US cryptocurrency exchange, froze hiring and rescinded some job offers.

While crypto prices have been dropping since early November, when Bitcoin reached its all-time high, the declines accelerated after the collapse of the TerraUSD (UST) stablecoin and related Luna cryptocurrency that resulted in losses of tens of billions in market value.

The market is also digesting bad economic news, which had hit tech stocks -- which many coins have shown correlation to -- particularly hard. Data released Friday on US consumer prices showed inflation continues to accelerate.

“The only event that mattered for markets this week was CPI, and the data yet again proved inflation is far from under control, which leads to higher interest rates, stronger dollar, lower stock and digital asset prices as investors continue to increase the probability of more rate hikes and a hard landing leading to recession,” said Jeff Dorman, chief investment officer at Arca.

©2022 Bloomberg L.P.