Jan 16, 2019

Crypto Winter Isn't Fatal For All ‘Picks and Shovels’ Makers

, Bloomberg News

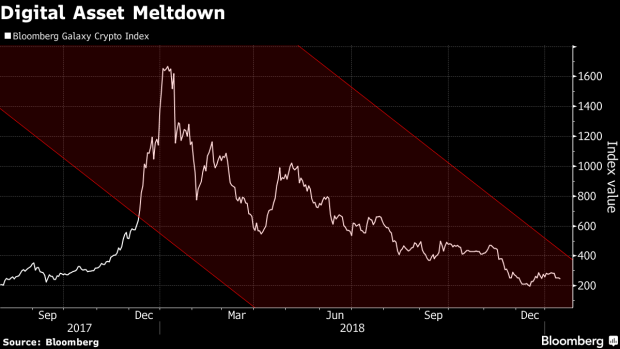

(Bloomberg) -- The crypto winter that’s seen major digital assets crash by as much as 90 percent hasn’t been bad for all of the firms building infrastructure or investors looking to pick up equity in projects that dropped appreciably.

"This is the most productive phase we’ve ever been in," said Konstantin Richter, chief executive officer of Blockdaemon, a firm that creates and hosts the computer nodes that make up blockchain networks. That’s because various efforts in the space need to deliver on their ambitions and are turning to firms like Blockdaemon for help. "Projects now need to show their colors. The time is up of raising a lot of money and talking a lot of talk," Richter said at a panel discussion hosted at the Los Angeles bureau of Bloomberg News.

After seeing cryptocurrency prices soar to records in late 2017 and early 2018 -- Bitcoin peaked near $20,000 and Ether traded over $1,300 -- the market had a disastrous time last year. Bitcoin is down about 80 percent with Ether having dropped about 90 percent. Investors and the public appear to have major concerns about what blockchain technology can actually deliver in the real world after hearing promises of its transformational potential.

"The skepticism is warranted in many ways because this technology is nascent and untested at an industrial scale," said Adam Jiwan, CEO of Spring Labs, which is using blockchain technology to build a decentralized credit-reporting system. He said the shakeout has been good for picking up employees who have seen their funding dry up or been cut loose from development firms. "Our hope is this presents us with a great opportunity to recruit talent," he said during the discussion.

The rise and fall of digital currencies validated the approach at Maco.la, a Los Angeles based investment, advisory and recruiting firm, said co-founder and principal advisor Sheri Kaiserman. That’s because the firm decided at inception last year to make equity investments rather than buying initial coin offerings, she said.

"We felt like the best way to make money is to buy the infrastructure companies -- the picks and shovels -- that are helping build the foundation," she said. "They are coming down in valuation, which is the best part of the crypto winter for us," Kaiserman said.

Maco.la is looking to invest in projects that avoid the repetitious work being done in the space at the moment as well as ones that have a high likelihood of being acquired, she said. "That’s why we focus on ones where we think Microsoft might be interested or that Google might be interested."

Blockchain, originally developed as the ledger technology that powers Bitcoin, is promising for corporations, if they can figure out how to use it. Proponents predict billions of dollars in savings by handling data and transactions more efficiently and rapidly. Yet most corporate efforts are still in early development or testing. Still, depending on when a blockchain startup raised funding, it could still have plenty of money to spend on development, Richter said.

"There are projects that are so well funded they’ll last for years," he said. Any ICO that went before the summer of 2017, for example, may have been able to buy Bitcoin at $600 compared to its current value of about $3,600, he said.

Health Care

Kaiserman said blockchain has the potential to radically change how global payments are made, specifically remittance payments when you factor in that Western Union charges 8 percent to 10 percent to send money compared with "a nominal cost" of Bitcoin transactions. There is also the chance to use it to give 1.1 billion people a digital identity around the world who currently lack a documented existence. Her favorite use is in health care, she said.

"I would love to be able to go to a doctor and the knowledge of my insurance is on the blockchain" so that "the insurance company knows that’s a covered diagnosis and there’s no need for reconciliation because we’re all sharing this one ledger," she said.

Spring Labs is advised by former Federal Deposit Insurance Corp. Chair Shelia Bair and former Goldman Sachs president and Trump administration chief economic advisor Gary Cohn. The firm avoided an ICO because they thought it would hurt adoption and risked regulatory scrutiny, Jiwan said. It’s working closely with regulators like the Securities and Exchange Commission to understand how to transition from a firm backed by equity to issuing a token that would be used on its network, he said.

In November, the SEC announced its first civil penalties against two crypto companies for allegedly violating securities offering registration rules with their ICOs. Both Airfox and Paragon Coin Inc. will need to pay $250,000 in penalties and register the digital tokens they sold through their ICOs as securities to resolve the matters against them, the SEC said Nov. 16. A few weeks later, commission Chairman Jay Clayton said cryptocurrency entrepreneurs should get their “act together” and register their initial coin offerings with the SEC if they want to avoid problems down the road.

"There’s some important issues in terms of straddling the transition from security tokens to utility tokens," Jiwan said. "The SEC’s primary concern is speculation ahead of actually delivering a functional technology, which, by the way, is reasonable," he said.

To contact the reporter on this story: Matthew Leising in Los Angeles at mleising@bloomberg.net

To contact the editors responsible for this story: Michael J. Moore at mmoore55@bloomberg.net, Dave Liedtka, Jeffrey Taylor

©2019 Bloomberg L.P.