Jun 21, 2021

Crypto World Paid Billions in Penalties Since Bitcoin’s Birth

, Bloomberg News

(Bloomberg) --

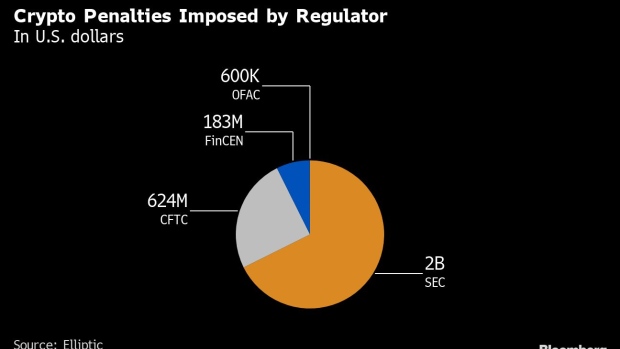

U.S. regulators imposed $2.5 billion in penalties on the cryptocurrency industry since Bitcoin’s birth in 2009, according to researcher Elliptic.

Securities and Exchange Commission actions accounted for the lion’s share, or $1.69 billion, Elliptic found. Commodity Futures Trading Commission penalties ranked second at $624 million. Most were imposed for firms offering unregistered securities and defrauding investors.

The bulk of the penalties came last year, when Telegram Group Inc. and its wholly owned subsidiary TON Issuer Inc. settled SEC charges for violating federal securities laws and agreed to return more than $1.2 billion to investors and to pay an $18.5 million civil penalty. Telegram didn’t deny or admit wrongdoing.

“These fines demonstrate that crypto is far from unregulated,” said Tom Robinson, co-founder of Elliptic. “Existing laws and regulations are already being used to limit and penalize illicit use of crypto assets.”

More recently the CFTC emerged as a major force imposing fines as well, according to Elliptic, which is used by regulators, financial institutions and other businesses to track cryptocurrency transactions.

Bitcoin hit its all-time high of nearly $65,000 in mid-April before sliding to around $37,000 in recent weeks.

“These penalties have not slowed down the crypto industry - in fact they have helped it to grow,” Robinson said. “They provide comfort to consumers, and regulatory clarity to businesses.”

Going forward, Robinson expects regulators to especially target overseas exchanges. In recent weeks, Bloomberg reported probes of world’s biggest exchange, Binance, by the CFTC and other agencies.

“The ransoms being paid to cyber crime groups are being cashed out at these exchanges, and addressing this will be key to reducing the number of ransomware attacks,” Robinson said. Recent ransomware attacks involving Bitcoin have impacted the Colonial Pipeline and JBS.

©2021 Bloomberg L.P.