Mar 9, 2020

Cryptos No Refuge in Market Carnage as Bitcoin Slumps to $8,000

, Bloomberg News

(Bloomberg) -- Cryptocurrencies are not immune to the gyrations rocking global markets, plunging along with a broad range of assets on Monday in the wake of the collapse in crude oil prices.

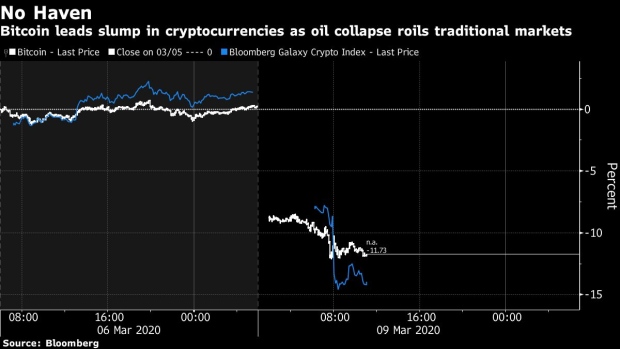

Bitcoin, the largest digital currency, dropped as much as 12% from Friday’s close after extending a sell-off begun over the weekend, and was trading just above $8,000 as of 11:44 a.m. in Hong Kong. That’s the biggest one-day slump since September, according to consolidated pricing compiled by Bloomberg.

The wider Bloomberg Galaxy Crypto Index fell as much as 16% as major cryptocurrencies Ether, XRP and Litecoin also retreated.

Asia equities plunged with sovereign bond yields, while currencies swung wildly on Monday after Brent oil prices crashed more than 30%, the second-largest decline on record after the plunge during the Gulf War in 1991.

“Macro dominoes are falling to create a chain of negative sentiment, which is in turn triggering a sell-off of crypto,” said Jehan Chu, managing partner with blockchain investment and advisory firm Kenetic Capital. “Bitcoin has always been subject to short-term sometimes-violent volatility, but today’s drop is nothing we haven’t seen before” and it could move lower still, he said.

There’s also a bullish argument, according to Chu -- that the weakness in the global economy, oil’s collapse and the coronavirus outbreak are helping to make the case for investing in digital assets.

Even with the latest sell-off, Bitcoin is still up 12% this year, with much debate within the industry on the potential impact on pricing of the upcoming “halvening” -- a scheduled reduction in the mining rate of the coin designed to combat inflation.

“A similarly rapid turnaround and appreciation is equally anticipated on the way to higher levels leading into the halvening,” he said.

To contact the reporter on this story: Eric Lam in Hong Kong at elam87@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Joanna Ossinger, Adam Haigh

©2020 Bloomberg L.P.