Nov 29, 2021

Currency Market’s Wild Swings on Omicron News Seen in Charts

, Bloomberg News

(Bloomberg) -- Currency markets are stabilizing as the week kicks off yet investors are betting on the possibility of further volatility in coming weeks.

Gauges of swings in the options market remain close to levels hit on Friday, when concerns that the Omicron coronavirus variant could derail policy tightening and lead to fresh travel curbs spurred erratic price moves. That’s leaving the cost of hedging elevated and demand for havens in favor.

Currencies Stabilize After Turmoil as Omicron Panic Subsides (3)

Here are four charts showing the sharp repricing for volatility.

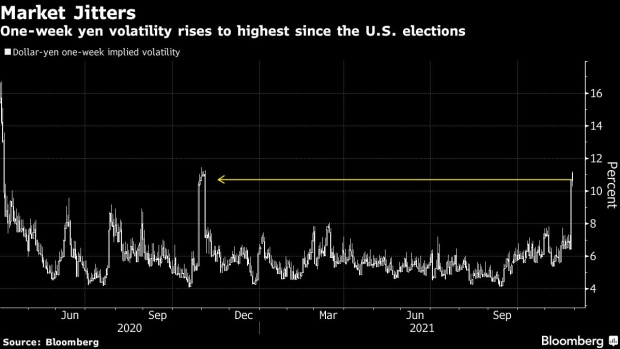

Hedging the yen over a one-week period is at its highest in more than a year at more than 10%, just off the peak seen before the U.S. elections in November 2020. The five-year average for the gauge stands at around 7%.

Demand for options that payout in a month’s time should the yen extend its recent advance versus the dollar has gone through the roof. Risk reversals have rallied sharply in favor of yen calls as bearish greenback sentiment reached the strongest since June 2020. The move was the fifth widest on record.

Market jitters are clearly evident in the volatility term structure of the Australian dollar-yen pair, a risk proxy for the currency market. The spread between the three-month and the one-week tenors has reached levels unseen in more than a year, as near-term uncertainty takes over.

Urgent Push to Gauge Omicron Threat on Claim Symptoms ‘Mild’ (2)

And it isn’t just haven or highly volatile currencies that are seeing oversized moves. Risk reversals, an options gauge of sentiment and positioning, have rallied in favor of buying the euro against the dollar by the most since the market turmoil of March 2020. That comes as investors are opting out of carry trades that used the euro as a funding currency.

- NOTE: Vassilis Karamanis is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice

©2021 Bloomberg L.P.