Dec 9, 2021

Currency Volatility Surges Ahead of Big Week for Central Banks

, Bloomberg News

(Bloomberg) -- Currency traders are taking no chances when it comes to next week’s policy decisions by the world’s major central banks.

One-week volatility for euro and sterling has risen to multi-month highs, with meetings by the Federal Reserve, the European Central Bank and the Bank of England in focus. Currency hedging costs were already elevated as investors assess the risks from the omicron variant and whether existing vaccines prevent infections.

The following charts show that it’s monetary policy dynamics that will be the main driver of currency moves into the Christmas holidays.

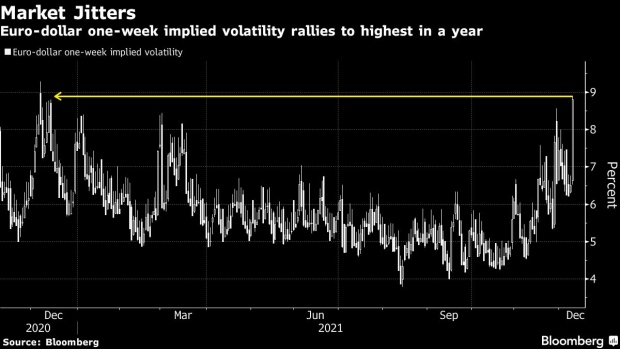

One-week volatility in the euro rose Thursday by as much as 238 basis points to touch 8.89%, a level unseen since December 2020. In comparison, the year-to-date average of the gauge stands at just 5.53%.

Traders expect the Fed to announce a faster pace of tapering and their updated dot plot next week, and are awaiting guidance by ECB officials on their plans for the end of the Pandemic Emergency Purchase Programme and the expansion of the Asset Purchase Programme. The importance of updated guidance can be seen in the euro’s inverted volatility term structure with the one-month, one-week spread falling short only of risk events like the U.S. elections and the March 2020 market mayhem.

As investors look for clues on whether the omicron variant will derail the BOE’s tightening plans, hedging costs are on the rise. One-week cable volatility has rallied toward the 10% handle for the first time since March. The relative premium on the tenor -- the spread between implied and realized volatility -- suggests options are the most overpriced this year.

Norway’s central bank also meets next week and hedging costs remain near cycle highs. Yet as policy makers’ plan to raise interest rates next week has been thrown into doubt by the emergence of the omicron variant, another run higher for krone volatility may be in the cards.

- NOTE: Vassilis Karamanis is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice

©2021 Bloomberg L.P.