Billionaire Stephen Ross Believes in South Florida—and Is Spending Big to Transform It

The Related Cos. founder is following the money flowing south by bringing his influence to everything from real estate to schools and health care.

Latest Videos

The information you requested is not available at this time, please check back again soon.

The Related Cos. founder is following the money flowing south by bringing his influence to everything from real estate to schools and health care.

Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

A South Florida office skyscraper from Related Cos. landed new finance tenants, including a John Paulson business and a private equity firm that counts Mark Bezos as a founding partner.

Oracle Corp. is moving its headquarters out of the city. Tesla Inc. is pulling back after a rapid expansion. Almost a quarter of commercial office space is vacant, and nowhere in the country have residential real estate prices fallen further from their pandemic peak.

Mortgage rates in the US increased for a fourth straight week.

Jun 17, 2018

, Bloomberg News

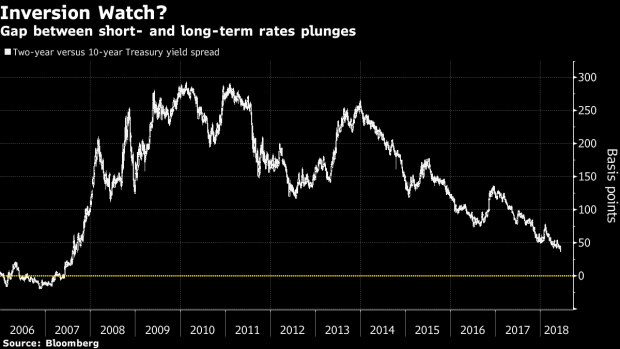

(Bloomberg) -- As the march toward yield-curve inversion picks up speed in the Treasuries market, Federal Reserve officials are about to get a fresh chance to sound off on the phenomenon.

With little top-tier U.S. economic data or supply to digest this week, traders will be on the lookout for any signals from policy makers, who have speeches lined up domestically and at a European Central Bank conference in Sintra, Portugal. The main event is an appearance by Fed Chair Jerome Powell, but the days ahead also bring comments from officials who expressed concern last month about the potential for inversion.

The shape of the curve has the market and policy makers on edge, given that inversion has historically preceded recessions, and some investors have speculated the Fed could alter policy to keep it from happening. For now, the momentum is clear, with more rate hikes in the cards and key technical support levels crumbling last week as measures of the curve reached their flattest since 2007.

“The curve-flattening bias continues to be the dominant trend in the market, but risks are building,” said Ian Pollick, head of North American rates strategy at Canadian Imperial Bank of Commerce. “You are going to get an outsized reaction to anything big coming out of the meeting” in Sintra.

The gap between 2- and 10-year yields has shrunk to about 37 basis points, after it narrowed last week by the most since March. It’s shriveled to 25 basis points for the 5- to 30-year spread.

Sensitive Times

The market’s sensitivity to Fed utterings on the topic was evident last month. When the release of the minutes from the May policy meeting showed officials were monitoring the shape of the curve, a bout of steepening followed. The ECB also added to the potential for a steepening pullback with its announcement last week that it will stop bond buying in December. That will bolster term premium and reduce the incentive for investors to buy U.S. debt, said CIBC’s Pollick.

On Friday, Dallas Fed President Robert Kaplan gave investors a taste of what may be ahead, saying he won’t “knowingly” back rate hikes that invert the curve. This week, the St. Louis Fed’s James Bullard and the Atlanta Fed’s Raphael Bostic, both of whom have expressed concern about the risk of inversion, are on the calendar.

Tom di Galoma, managing director of government trading and strategy at Seaport Global Holdings, still sees inversion as inevitable. Last week’s break in the spread between 2- and 10-year yields below 40 basis points sets up key support at 25 basis points, followed by 12 basis points and 3 basis points, he said.

“As long as the Fed is raising rates, we are going to continue to flatten the curve because there doesn’t seem to be any real inflation,” said Ray Remy, head of fixed income at Daiwa Capital Markets America Inc. “But you have the trade wars, which does lead to inflation, so we’ll see.”

At the end of last week at least, trade friction boosted Treasuries. Bonds drew some haven buying after the Trump administration announced tariffs on $50 billion in Chinese imports and pledged additional investment restrictions, which Beijing immediately vowed to retaliate against.

What to Watch This Week

To contact the reporter on this story: Liz Capo McCormick in New York at emccormick7@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum, Jenny Paris

©2018 Bloomberg L.P.