Jun 8, 2022

Czech President Shakes Up Central Bank by Removing Rate Hawks

, Bloomberg News

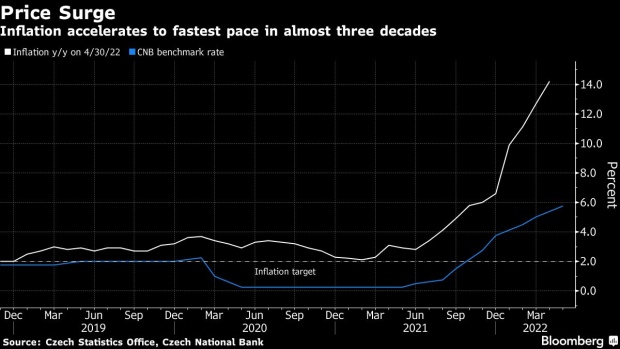

(Bloomberg) -- Czech President Milos Zeman is revamping the central bank after criticizing it for overly aggressive interest-rate increases to combat the fastest growth in livings costs in nearly 30 years.

Zeman, who has the sole right to pick central bankers, named three new members to the policy making board on Wednesday, refusing second terms to two hawkish rate setters. The changes follow last month’s surprising appointment of Ales Michl, who has been a vocal opponent of the rapid monetary tightening, as the new governor.

Read more: Koruna Turmoil Shows Dilemma for New Czech Central Bank Boss

The president picked Eva Zamrazilova, Jan Frait and Karina Kubelkova to take seats on the board, along with Michl assuming the helm, at the beginning of July. The changes are a manifestation of Zeman’s views that inflation is largely caused by shocks from abroad and that too much monetary tightening may be helping to drive up prices. Zamrazilova will become the deputy governor.

While the koruna fell sharply after Michl’s appointment last month, naming Frait and Zamrazilova should be seen as positive by investors because they have already held board positions, according to analysts at brokerage Patria Finance. Little is known of Kubelkova’s views.

Still, it will be “bad news” for the market that Deputy Governor Tomas Nidetzky and board member Vojtech Benda, who consistently backed the bank’s tightening drive, didn’t secure second terms, Patria said.

“Therefore the koruna may remain under pressure, at least in the short term, and the central bank will have to defend it more actively,” it said in a report.

Last month’s koruna selloff prompted policy makers to intervene in the market to prop up the currency. Michl has since said the market move was caused by speculative outflows as investors had expected more hikes.

Read more: Koruna Turmoil Shows Dilemma for New Czech Central Bank Boss

After voting against all eight interest rate increases over the past year, which raised the benchmark by a cumulative 550 basis points, Michl said borrowing costs should be high enough to contain home-grown inflation risks when he takes over the bank.

But he left the door open for more potential tightening if strong demand threats emerge.

The central bank last raised rates in May, by 75 basis points to 5.75%, as the majority of the board feared that cost shocks from abroad were quickly spilling over into the broader economy and may fuel wage demands.

The rate-setting panel will hold one more decision in its current make-up on June 22. Outgoing Governor Jiri Rusnok has said persistent inflation pressures may require another hike of at least three-quarters of a percentage point.

©2022 Bloomberg L.P.