Jun 24, 2019

Daimler cuts 2019 forecast as diesel bites again

, Bloomberg News

Daimler Warns on Diesel Troubles

Just one month into the job, Daimler AG’s executive duo is back to unearthing skeletons from the diesel-scandal era, hobbling the move toward an electric future with a crisis that erupted almost four years ago.

Operating profit this year will fail to grow, Daimler said late Sunday in its third downgrade in a year, after previously promising a slight earnings gain for 2019. The company blamed proceedings around allegations of emissions tampering in diesel cars for the more muted outlook, which required higher provisions to account for recalls. The stock fell as much as 5.1 per cent, almost erasing the gain that Daimler had built up since the start of the year.

The more pessimistic outlook heaps pressure on Chief Executive Officer Ola Kallenius and Chief Financial Officer Harald Wilhelm to implement their proposal to rein in costs and restore profitability, having taken over only recently from long-term CEO Dieter Zetsche. But investors say the duo’s future strategy remains light on details, while lamenting the rapidly recurring revisions that are without precedent in the German car industry.

“It all comes back to the same old fact: Daimler needs to execute better,” said Arndt Ellinghorst, an analyst in London at Evercore. “The endless array of so called “one-time” effects raises questions regarding process, management information systems and ultimately accountability of management.”

UPS AND DOWNS

Zetsche’s own tenure of more than a dozen years had known its ups and downs, skewed towards the latter in the period before his departure. After managing to return Daimler to the top of the luxury-car pack, his last year at the helm was marked by two profit warnings and a falling stock, which ended the year down by more than a third, a considerably poorer return than its two big German rivals, BMW AG and Volkswagen AG.

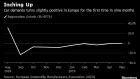

The German car industry is facing a litany of issues, from the costly switch to electric and self-driving cars, to the trade war between the U.S. and China that has complicated sales, because some of the biggest production sites sit in the U.S. and ship their cars to Asia.

And while the diesel crisis first erupted at VW in late 2015, it has engulfed the entire industry. Days before the latest warning, Daimler suffered a fresh setback when German regulators issued a mandatory recall for about 40,000 Mercedes GLK SUVs over potentially illegal software to skirt emissions rules. A spokesman declined to comment on a connection to the profit warning.

German authorities already slapped Daimler with a recall of 774,000 diesel cars in Europe last June over the use of prohibited devices regulating their emissions. The company continues to claim a clean-engine record.

CORPORATE CULTURE

“Clearly both the near term operational challenges and possible questions around Daimler’s corporate culture are issues that must be addressed with urgency by Daimler’s new CEO,” Dorothee Cresswell, an analyst at Barclays Equity Research, said in a June 24 note.

The German manufacturer is facing investigations in Europe and the U.S. over allegedly excessive pollution from its diesel vehicles. Daimler has agreed to software upgrades for millions of cars in Europe, while so far escaping fines. That’s in contrast to VW, where the scandal has so far cost the world’s biggest carmaker 30 billion euros (US$34 billion) in fines and provisions.

REGULATORY SCRUTINY

Highlighting the breadth of issues, Daimler on Sunday also warned that its struggling van unit will be unprofitable this year, with a return of sales of minus two per cent to minus four per cent. The division slumped to a surprise loss in the first quarter as plans to produce a Mercedes-Benz pickup truck in South America fell through.

For Kallenius and Wilhelm, the latest revision offers a chance to clean house ahead of a more comprehensive overhaul. Last month, shareholders approved a new corporate structure that will give its divisions for cars, trucks and mobility services more independence. While Daimler’s woes at the Mercedes-Benz cars division underscores the urgency behind the move, it could rally criticism from some investors to implement deeper changes, including a separate listing for the sprawling trucks division, a step that would mimic a move by VW.

Kallenius may be new in his job, but he’s no stranger to Daimler, having worked for the company his entire professional life. Wilhelm, too, is familiar with the company, having worked at the carmaker prior to his years spent as finance chief for Airbus SE. Still, the duo may find that they’ve not reached the bottom yet in terms of financial expectations for the year, said said Marc-Rene Tonn, an analyst at Warburg Research, citing a “less favorable” sales mix and supply chain constraints.

“We fear that Sunday’s profit warning may not be the last for the current year,” he said.