Jul 20, 2019

Danger Lurks for Stock Managers Chained to Crowded Trades

, Bloomberg News

(Bloomberg) -- It’s an old saw of professional money management that nobody gets fired for buying IBM. But in 2019, the perils of groupthink may be creating their own kind of career risk for stock investors.

So says Bank of America, highlighting dangers created when droves of funds flock to the same stocks regardless of cost. In one extreme example tied to the vogue for momentum trading, shares with the fastest price appreciation over the past 12 months are trading at valuations that are almost 25% higher than normal, the bank’s data showed.

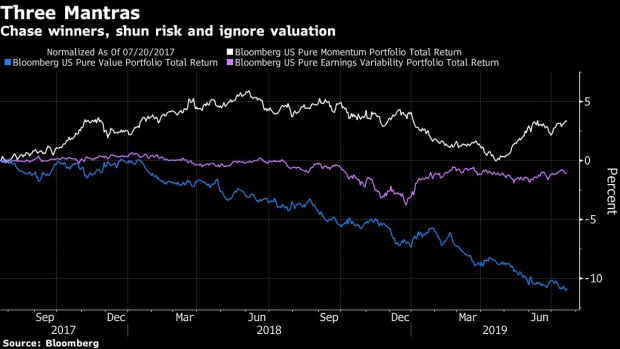

While risk aversion and herding are nothing new, the extent to which active funds are willing to pay up for popular stocks is at extreme levels. Three mantras seem to dominate their thinking, say BofA strategists led by Savita Subramanian. “Buy what’s working,” “don’t be different,” and “valuation doesn’t matter.”

Normally, you want to buy low and sell high. Lately investors seem to have it backwards. Cheap stocks are being almost totally neglected -- the value group is 20% under-owned by managers. Also abandoned is anything that Wall Street doesn’t believe it has figured out. For instance, companies with the highest dispersion in earnings estimates are offered at a 51% discount to their long-term average.

So prevalent is the fear of going against consensus that portfolios now resemble each other like never before. BofA studied the top 50 stock holdings between mutual funds and hedge funds, and found the overlap is close to record highs.

On certain levels, money managers can be forgiven for staying close to the pack. After all, it’s easier to stay out of trouble when everyone makes the same mistake. But that does not guarantee career safety, says Subramanian. In her thinking, the prevailing preference for chasing winners and shunning risk still poses a “career risk."

Active funds got a taste of the potential hazard in June, when stocks they were ignoring staged a strong comeback. Value and risky stocks as a group tracked by BofA each jumped 10%, beating the market after lagging in May.

The turnaround is one reason that BofA says fund returns worsened last month relative to the market. The proportion of large-cap funds beating their benchmarks year-to-date slipped to 41% from 47% in the previous month, the firm’s data showed.

“Fund managers got whipsawed from May to June and performance suffered,” Subramanian wrote in a note earlier this week. “Reversals are now causing investor pain.”

To contact the reporter on this story: Lu Wang in New York at lwang8@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Chris Nagi

©2019 Bloomberg L.P.