Oct 19, 2022

Dark Pool Index Shows Epic Bearishness Among Retail Traders

, Bloomberg News

(Bloomberg) -- The stock market might be trying to bounce back, but one group of investors is staying on the sidelines: retail traders.

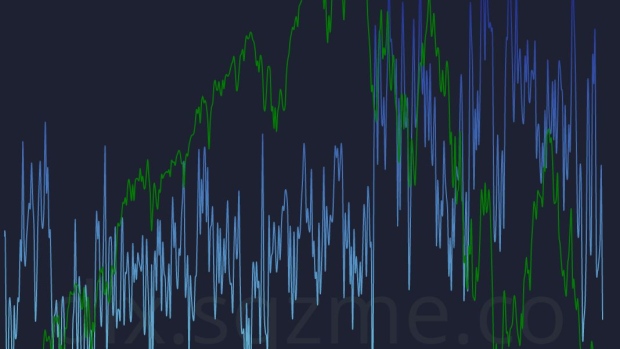

That’s according to an esoteric indicator designed to track small-time speculators, something known as the Dark Index that is kept by options-analysis firm SqueezeMetrics. Its current reading -- 40.9% -- is hovering around the lowest levels on record and is near a 2022 trough, meaning that the group is “selling into the rally.”

It’s another read on what at-home traders, who helped ignite rallies in 2020 and 2021, are doing now that a bull market run up has given way to a deep decline. The S&P 500 has been mired in a downtrend for months and has fallen over 22% since the start of the year. Treasuries have been suffering as well, and it’s possible that retail investors are moving money out of stocks and toward bonds instead as yields look more appealing.

“There is significantly less demand for stocks now because more demand is out there -- just beginning -- for Treasuries,” said Matthew Zambito, founder of SqueezeMetrics. “People are reaching for that risk-free yield and are deciding not to put more cash in stocks.”

SqueezeMetrics’ DIX indicator is premised on the idea that on certain high-volume stock trading venues, short sales become a marker for retail buying. While normally denoting directional bets that stocks will fall, the “short” tag also gets attached to certain sales by market makers who in some cases don’t own the stocks for which they’re quoting prices in places like dark pools.

The index has sagged in recent weeks in what’s been a choppy stretch for stocks, during which the S&P 500 has posted numerous sessions with gains or losses of greater than 2%.

Retail-investor favorites have made out terribly this year, with a basket tracked by Goldman Sachs down about 41% and an ETF made up of stocks most loved by investors online lower by 45%. Meanwhile, the yield on 10-year Treasuries, meanwhile, is hovering around 4.1%.

“The idea that buying the dip failed -- it sure looks like it -- but maybe the stock market can languish for a little while,” said Zambito. “But in the meantime, I can get a 4% yield or better, that’s appealing. And I think that’s probably what’s going on in a lot of people’s heads.”

Earlier: Dark Pool Indicator Shows Stock-Dabbler Set Is Beating a Retreat

Other readings on retail sentiment are also in the gutter. The so-called “Dumb Money Confidence” model from Sundial Capital Research, which incorporates a number of indicators, at the end of September hovered around the lowest level since March 2020 and one of the lowest within the last 10 years -- although such gauges can sometimes be seen as contrarian.

Art Hogan, chief market strategist at B. Riley, says it’s possible that some investors are looking at certain technical or round-number levels -- like 3,600 or 3,700 -- on the S&P and offloading whenever the index hits those marks. “Does it make sense that retail is nervous about the future and selling into rallies? Absolutely,” he said in an interview.

©2022 Bloomberg L.P.