Nov 29, 2019

David Driscoll's Top Picks: Nov. 29, 2019

BNN Bloomberg

Full episode: Market Call Tonight for Friday, November 29, 2019

David Driscoll, president and CEO of Liberty International Investment Management

Focus: Global stocks

MARKET OUTLOOK

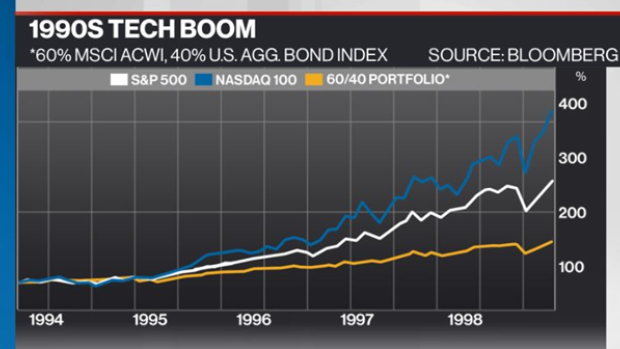

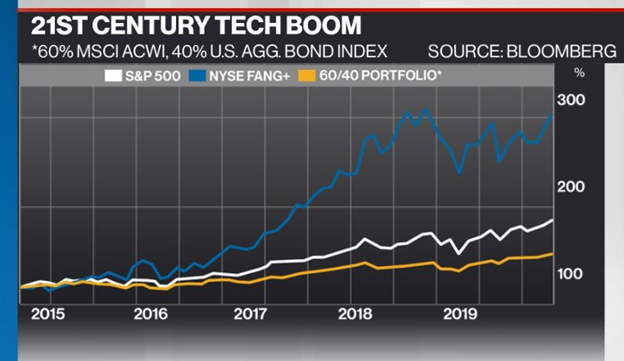

There appears to be an anomaly between the bond market and NASDAQ technology stocks. With the three interest rate cuts in 2019 by the U.S. Federal Reserve and another round of quantitative easing (bond-buying, especially in the repo market), the yield curve has flattened, signaling the bond market expects slower economic growth. Meantime, the NASDAQ continues to hit new highs as the rate cuts have signaled greater growth is in store for technology companies. Unfortunately, only one outlook can be right, which brings us back to the NASDAQ.

As the charts above show, it appears the index is getting ahead of itself, similar to 1998 and two years before the tech bubble imploded in March 2000. This movement implies that either investors are piling in for fear of missing out, or technology stock growth rates will continue to exceed reality in a slower-growth environment.

As a result, it’s important for investors to tread carefully and be fully aware of the multiples they wish to pay to join the NASDAQ-buying party. And if one of their tech stocks or tech ETFs doubles in price from where they bought it, prudence dictates that selling half and re-balancing can prevent any future “bubble-popping” from hurting their retirement plans.

TOP PICKS

KARDEX (KARN SW)

Last purchased on Nov. 12 at 150.60 CHF.

Kardex is a global industry partner for intra-logistic solutions and a leading supplier of automated storage solutions and material handling systems. Only about 10 per cent of warehouses globally use logistics, so there’s a large runway of opportunity for the company. The stock yields 2.45 per cent, earnings and cash flow growth are expected to be in the double digits, it has no debt and offers a free cash flow yield of 2.74 per cent. Current assets are twice liabilities, its return on invested capital (ROIC) is 23 per cent and the weighted average cost of capital (WACC) is 11 per cent. The difference is essentially free cash flow.

STANTEC (STN:CT)

Last purchased on Nov. 27 at $35.48.

Stantec is a Canadian engineering/architectural firm notably in the infrastructure and environment space that has solid future potential. It purchased a British firm for its environmental assets, but had to sell/writedown assets that affected its earnings and share price. Essentially, it’s now coming out of the equity doghouse and its recent earnings pointed to better performance, with the stock jumping 12 per cent that day. As global warming causes future calamities, Stantec’s services should be in demand. Good cash flow and dividend growth may be expected.

NOVO-NORDISK (NVO:UN)

Last purchased on Nov. 27 at $56.49.

Novo-Nordisk focuses on diabetes care and offers insulin delivery systems. It recently received FDA approval of Rybelsus, a once-daily tablet for people with Type 2 Diabetes. The dividend yield is 2.13 per cent and investors should see a resumption of higher dividend growth. It has an ROIC of 22 per cent versus a WACC of 13 per cent. Current assets are greater than total liabilities and from an ecology standpoint, the company’s manufacturing plants will be powered 100 per cent by renewable energy.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| KARN | Y | Y | Y |

| STN | Y | Y | Y |

| NVO | Y | Y | Y |

PAST PICKS: NOV. 2, 2018

TC ENERGY (TRP:CT)

- Then: $50.75

- Now: $67.20

- Return: 32%

- Total return: 39%

UNILEVER (UN:UN)

- Then: $53.94

- Now: $59.55

- Return: 10%

- Total return: 14%

BECTON DICKINSON (DBX:UN)

- Then: $235.58

- Now: $258.50

- Return: 10%

- Total return: 11%

Total return average: 21%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| TRP | Y | Y | Y |

| UN | Y | Y | Y |

| DBX | Y | Y | Y |

WEBSITE: libertyiim.com