Jan 26, 2022

Day-Trader Interest in Put Options Adds to Capitulation Fears

, Bloomberg News

(Bloomberg) -- Day traders who populate Reddit’s WallStreetBets forum are increasingly seeking protection from more pain after a selloff rocked the high-flying technology companies and meme stocks preferred by individual investors.

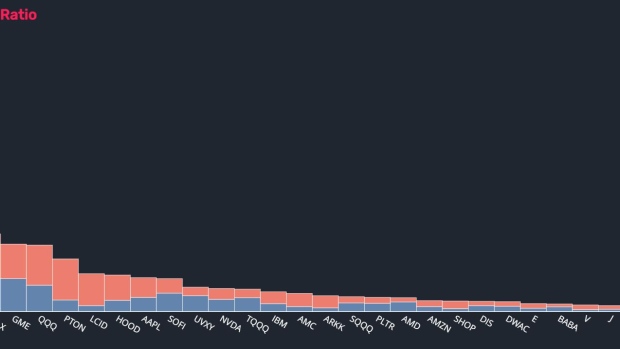

Sentiment on the platform has flipped with more posts and comments focusing on buying put options instead of calls, according to Vanda Research. The increase in mentions of the protective derivatives were also shown in data compiled by alternative markets data aggregator Quiver Quantitative.

“For the first time since the pandemic started, mentions to put options have overtaken references to calls,” according to Ben Onatibia and Giacomo Pierantoni of VandaTrack Research. That suggests “the Reddit crowd is indeed throwing in the towel.”

The souring sentiment is another sign individual investors who have had a rough start to the year are seeking protection, with favorites like Tesla Inc. down more than 10% and Nvidia Corp. shedding a fifth of its value. The S&P 500 Index, lower by 7.7%, is on pace for its worst month since the pandemic hit in March 2020.

WallStreetBets users’ mentions of puts on the world’s largest exchange-traded fund, the SPDR S&P 500 ETF Trust (ticker SPY), have blown past touts of trading call options, according to data compiled by Quiver Quantitative. The same is apparent for Tesla and Netflix Inc.

The anxiety for retail investors who may be experiencing their first correction contrasts with trends seen for Wall Street pros. Put open interest in the SPY has plunged to the lowest since 2014, signaling a dramatic drop in demand for protection by the overall market.

Wednesday’s market rebound may be a sign hedge funds are right as the S&P 500 jumped as much as 2%, while the Nasdaq 100 outperformed major benchmarks.

Even so, Vanda argues that the combination of rising interest in put options as well as retail investors’ waning demand to snap up risky assets like meme stocks and special-purpose acquisition companies signals “retail capitulation may not be that distant after all.”

©2022 Bloomberg L.P.