Aug 10, 2022

Debt Issuers Wonder If ESG Label Is Worth It as Skepticism Spreads

, Bloomberg News

(Bloomberg) -- Bond issuers appear to be reviewing the merits of tapping the ESG debt market, based on an assessment that the lower financing costs the label generally brings aren’t worth the risk of being exposed to greenwash accusations.

“There’s a number of issuers that are reconsidering the cost benefit trade-off,” Jason Taylor, the managing director for sustainability advisory and finance at National Bank of Canada, said in an interview.

“When you define a successful sustainable finance transaction, there’s a lot of dimensions by which you can analyze it,” he said. “One is the cost savings from the greenium. But if it comes with a high level of scrutiny post transaction, it can cause some people to really second-guess whether that one or two basis points is really worth the risk of having perhaps a couple of very uncomfortable articles written.”

Sustainable Debt Issuance

For now, much of the regulatory crackdown on greenwashing has centered on asset managers. But the finance industry has itself repeatedly raised concerns around the risks lurking in some corners of the market for environmental, social and governance debt.

Goldman Sachs Group Inc.’s NN Investment Partners is among asset managers getting pickier and is increasingly rejecting ESG debt pitches, it said last month. Isobel Edwards, a green bond analyst at the firm, said she and her team are often incredulous when they see some of the claims issuers make.

“We tend to call it a greenwash when it comes to the market with everything 100% aligned and everything is the greenest it can possibly be, the sustainability plan is the best on the market,” she said in a July interview. And in June, a manager at JPMorgan Chase & Co. revealed his misgivings over many of the ESG loan pitches crossing his desk.

Issuers increasingly have to contend with the reputational risk of sending ESG debt to market that may not yet be fit for purpose. Chanel -- best known for its No. 5 perfume and iconic tweed suits -- was recently called out for missing an interim renewable energy target for 2021 on a sustainability-linked bond. And last year it emerged that an ESG bond issued by Tesco Plc, the UK’s biggest grocery chain, was based on targets that covered only 2% of its annual emissions.

Read More: Sustainable Debt Issuance Could Exceed $1 Trillion in 2022

In September, Bloomberg News published an analysis of over 70 sustainability-linked revolving credit lines and term loans arranged in the US since 2018, revealing that over a quarter contained no penalty for falling short of stated goals, and only a minuscule discount if targets were met.

“Greenwashing across the board is going to be more and more scrutinized as we head into 2030,” Taylor said. With investors and regulators increasingly alert to the risk of exaggerated ESG claims, fund managers are also growing more cautious.

In Europe, a case in point is the evolving language that asset managers are using around a product called Article 8. Defined within EU sustainable finance disclosure regulations as a product that “promotes” sustainability, a number of investment managers are nonetheless choosing not to attach an ESG label.

“The whole industry across the board is perhaps becoming a little more cautious and thinking through reps and warrants being made,” Taylor said. He said that issuers aren’t necessarily foregoing labeling altogether, but taking their time to make sure that if they tap the ESG market, they haven’t overlooked any metrics that could morph into PR embarrassments.

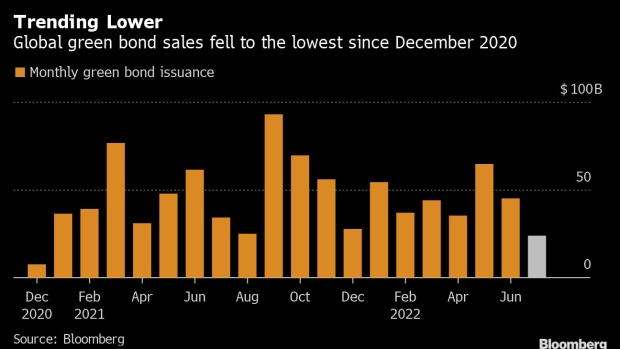

Read More: Green Bond Sales Drop to 19-Month Low on Tight Issuance Windows

Some companies have expressed reservations about issuing ultra-long green debt in particular, citing a fast-changing regulatory landscape and reputational risks. Green bond issuers could opt to reduce tenors to avoid jeopardizing their green credentials as market thresholds tighten, according to Maia Godemer, associate at BloombergNEF.

The International Capital Market Association, a financial industry group, released more stringent -- albeit voluntary -- standards for sustainability-linked debt earlier this summer, and European lawmakers are in the process of creating a green bond standard. But both issuers and asset managers need to navigate continuing changes to ESG rules, and firms risk inadvertently misstating their ESG metrics, according to Taylor.

“Greenwashing isn’t necessarily always voluntary,” Taylor said. But “standards are also developing at a faster rate so those gray zones are dissipating more and more. Over time, the market’s going to tighten up on its own,” he said.

(Adds reference to investment funds also avoiding ESG label in 10th paragraph)

©2022 Bloomberg L.P.