Griffin’s Citadel to Relocate London Offices to New Development

Ken Griffin’s Citadel and Citadel Securities will move their London spot to a new office tower on the edge of the City of London.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Ken Griffin’s Citadel and Citadel Securities will move their London spot to a new office tower on the edge of the City of London.

Persistent inflation risks and hawkish signals from the US Federal Reserve are preventing the Czech central bank from accelerating its interest-rate cuts, according to board member Jan Prochazka.

Global stocks and Asian currencies rallied as authorities pushed back against a stronger dollar, helping restore a sense of confidence in financial markets.

President Joe Biden called China “xenophobic” while highlighting the Asian nation’s economic woes, as he sought to make the case for US economic strength during a campaign stop in the swing state of Pennsylvania.

Freddie Mac is seeking regulatory approval to expand into guaranteeing second mortgages, a shift that would potentially drive down costs for Americans seeking to borrow against the equity in their home.

Sep 28, 2020

, Bloomberg News

(Bloomberg) -- Credit investors are once again contemplating nightmare scenarios for China Evergrande Group. But the world’s most indebted real estate company has a series of funding options that could help it avert a market-destabilizing cash crunch.

Asset sales, stock listings and a boost in holiday condo sales are among ways that the property developer can restore investor confidence after its stock and several bonds plunged last week before rebounding Monday. Evergrande units could raise as much as $9.3 billion from stock sales alone, according to estimates from Glenn Ko at HSBC Holdings Plc.

The developer doesn’t have a lot of time. Strategic investors have the right to demand repayments for the $19 billion they poured into the company three years ago unless Evergrande is able to win a listing in China by Jan. 31. The timing for a decision isn’t clear, but some analysts doubt Evergrande will get approval as policymakers restrict funding options for developers to cool market speculation.

Without the Shenzhen listing, here are some of the alternatives for Evergrande to raise money or reduce costs to pare its $120 billion debt load:

Hong Kong IPO

Evergrande is planning to tap the soaring demand for property management companies by spinning off its services business via a listing on the Hong Kong stock exchange. The Shenzhen-based developer won approval last week for the sale, which could raise $1 billion to $2 billion, people familiar with the matter said. HSBC said the initial public offering could raise as much as 30 billion yuan ($4.4 billion) by year end.

The unit is valued at about $11 billion based on a recent funding round that raised $3 billion, and could soon join service firms such as Times Neighbourhood Holdings Ltd. that are winning lofty valuations from demand for butler-like services from the millions of condos in China.

Hong Kong Sale

If the China listing fails, Evergrande could look to a secondary stock sale in Hong Kong, where it already trades. Any additional sales in Hong Kong wouldn’t be subject to the mainland securities regulators, according to Bloomberg Intelligence analysts Kristy Hung and Patrick Wong:

Evergrande’s aim for a backdoor listing in mainland China could backfire, with Chinese developers increasingly looking to Hong Kong for equity raising instead of at home.

Evergrande would join 13 developers that have raised $12.9 billion in additional equity in Hong Kong since 2017, the BI analysts note. That dwarfs the $58 million raised by the sector in China over the same period.

Sell Condos

Evergrande is counting on a surge in real estate sales to raise additional cash for its debt obligations and possibly repay the strategic investors. The firm has raised 452 billion yuan in cash from property sales this year to Sept. 24, an increase of 51% from a year earlier, according to HSBC. More condo sales are expected from the “golden week” holidays, which start Oct. 1.

Last month, Evergrande targeted 200 billion yuan of project sales in September and October, led by a sales promotion with deep discounts. The developer may also reduce its land purchases to preserve cash, according to a report by analysts at CGS-CIMB in Hong Kong.

Refinance

Beijing is looking to tighten access to funding across China’s highly indebted property sector. The widely circulated “three red lines” policy restricting bank borrowing for real estate firms may impact some lower-rated issuers, according to S&P.

Evergrande has probably crossed the “red lines,” meaning selling new bonds will be difficult if the policy is implemented, though they could continue to refinance existing debt, HSBC said.

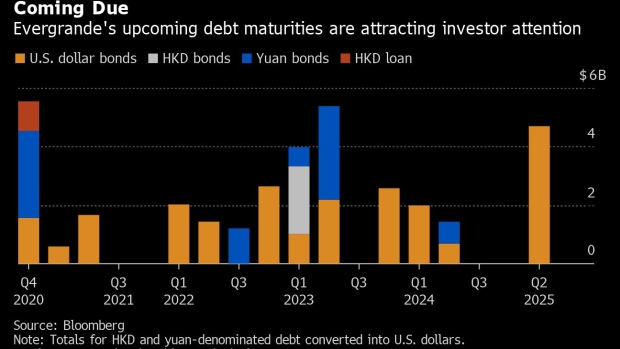

The developer will have to repay about $5.8 billion of bonds and loans over the next two months, raising the prospect of sharply higher refinancing costs if investors balk.

Tap Bank Assets

Banks and trust firms, with almost 600 billion yuan of outstanding debt, have turned more cautious on Evergrande, threatening to cut off its biggest source of funding. Several banks have decided not to allow the developer to draw on unused credit lines, while some trust firms called Evergrande last week to gauge the prospect of repaying the investors on time, according to people familiar with the matter.

Evergrande has a trove of financial assets it could sell to ease the immediate crunch. Last year it raised its stake in Shengjing Bank Co., a lender with over 1 trillion yuan of assets in the northeast province of Liaoning. It currently owns 36% and is the largest shareholder, with a stake worth about HK$22 billion ($2.8 billion). It also holds 50% of Evergrande Life Insurance, with assets of 189 billion yuan.

Other Assets

Billionaire Hui Ka Yan, who controls Evergrande and has amassed a fortune worth $22 billion, has other asset levers to pull if he chooses. Among his prized possessions is the Guangzhou Evergrande Taobao soccer team, the most valuable club in China, according to Forbes. The developer could also look to sell a portion of its massive land holdings.

Hui has aspirations to take on Elon Musk in the electric vehicle business, through China Evergrande New Energy Vehicle Group Ltd. The auto unit plans to list shares in Shanghai, a transaction that CGS-CIMB analysts said could reduce net gearing by 30 percentage points. The stock sale could raise 34 billion yuan, according to HSBC estimates. Unlike the parent company’s shares, which are down about 23% this year, the electric vehicle stock has jumped 160% in Hong Kong.

Buy Time

While one of the strategic investors -- Suning Appliance Group -- has indicated it won’t extend the deadline for repayment beyond January, it’s not clear if the other investors will be as rigid. Many of them are Evergrande suppliers with long-standing relationships.

“Suning’s case is a bit unique as the company’s liquidity is tight,” HSBC said in its note. “The request for full redemption” by Jan. 31 is unlikely.

Another option for the strategic investors is to accept shares of Evergrande or the other units, HSBC said. With a 72% stake, Hui could dilute his shares and still maintain control.

Frank Pan at JP Morgan Chase & Co. agrees on the potential extension: “Our base case remains that Evergrande would reach a mutual agreement with the investors should it miss the extended deadline again, leading to another extension.”

©2020 Bloomberg L.P.