Jan 19, 2019

December's Stock Carnage Sets Stage for Peaceful Earnings Season

, Bloomberg News

(Bloomberg) -- So much damage was done to optimism in December’s market trauma that keeping Wall Street satisfied through earnings season may turn out to be relatively easy.

That’s according to John Normand, JPMorgan Chase & Co.’s head of cross-asset strategy. After witnessing the bottom fall out of the S&P 500 in the worst December since the Great Depression, investors are likely to ask less of U.S. companies as they disclose fourth-quarter results.

Profits in the period are forecast to rise 12 percent from a year ago, about half the pace of the previous quarter. A slowdown like that is probably already reflected in stock prices after analysts spent most of the past month lowering their estimates. With a little more than 10 percent of company reports already on the books, stocks have risen about 1 percent on average the day after reporting, according to data compiled by Bloomberg.

“Given significant de-leveraging has already taken place across investors during 4Q18, stock prices should be more resilient to earnings softness than in prior quarters,” Normand said in a note to clients. “This earnings backdrop coupled with depressed valuation and investor positioning should provide the potential for S&P 500 to reach 3,000 this year.”

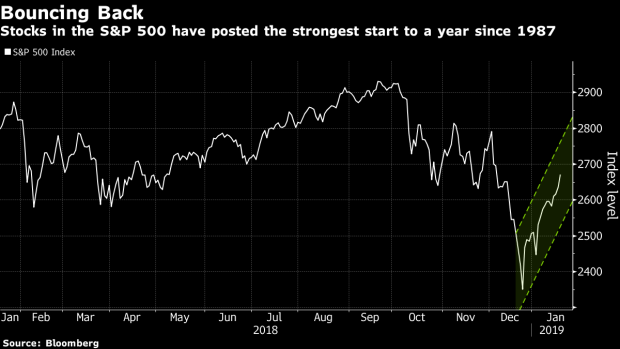

Even after the best start to a year since 1987, the S&P 500 is trading at just over 18 times annual earnings. That’s down from 21 times as recently as September and more than 23 times a year ago. Lower valuations may provide a cushion for companies that disappoint.

To contact the reporter on this story: Elena Popina in New York at epopina@bloomberg.net

To contact the editors responsible for this story: Courtney Dentch at cdentch1@bloomberg.net, Chris Nagi, Richard Richtmyer

©2019 Bloomberg L.P.