Jan 26, 2023

DeFi Used to Be Crypto’s Hottest Sector. Now It’s Facing a Big Downtown.

, Bloomberg News

(Bloomberg) -- Declining interest in decentralized finance is calling into question whether it really is the next frontier of crypto.

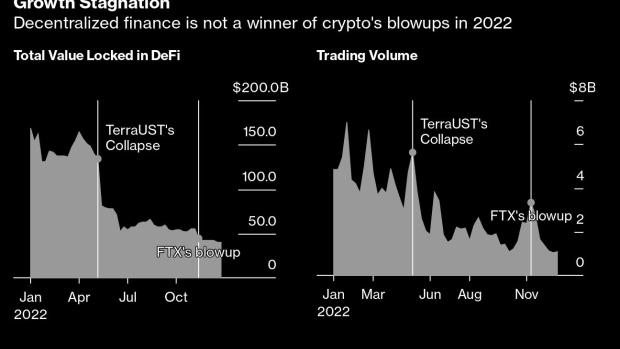

DeFi projects — such as peer-to-peer lending or decentralized autonomous organizations — were assumed to be the beneficiary of FTX’s collapse last year when investors pulled billions of dollars out of cryptocurrencies. But a closer look shows that hasn’t been the case, even though DeFi tokens have historically outperformed the sector.

DeFi trading volume has more than halved; the total value of crypto tokens locked in DeFi protocols has been mostly flat for months; and DeFi’s once lofty returns are nowhere to be found. Investors both at the retail and institutional level are less willing to look past security risks and regulatory uncertainty. And with solutions to those problems still years away, a number of DeFi projects may not survive the downturn.

“One thing that’s hard for people to internalize is the timing of new markets and just how long it usually takes for great products to be built on new technology,” said Antonio Juliano, founder and CEO of decentralized exchange dYdX. “That’s actually the root cause of a lot of this boom and bust cycle that we see in crypto.”

Like Bitcoin, DeFi’s performance is down by more than half its 2021 peak, according to data tracker DeFi Llama. For a time, DeFi’s explosive growth promised to replace traditional finance, or tradfi, when it was offering double- or triple-digit returns in an era of ultra-low interest rates. But 2022’s decline in risk appetite and multiple crypto blowups show the downsides of both an automated- and incentive-based system. Demand has fallen and DeFi yields are mostly below 3% now on platforms such as Aave and Compound, data provided by blockchain data firm Kaiko shows.

The total value locked in DeFi protocols is down to less than $50 billion, mostly concentrated on 15 projects, which means most initiatives will struggle to gain traction. Top projects like Juliano’s dYdX or Lido Finance have enough cash for at least five years, according to recent announcements and interviews. But that may not be enough as big ideas require long runways. A decentralized exchange, for instance, will need at least five to 10 years to compete “head to head” with centralized exchanges, Juliano said.

“There have been some core teams of protocols that have either significantly downsized or gotten acquired or something,” Juliano said. “I think that will be a trend that continues.”

Investors were rattled by last year’s bout of crypto meltdowns — including the collapse of Terra’s so-called stablecoin — heightening concerns about security and legislation. At the same time, DeFi hackers grossed over $3 billion in more than 125 attacks last year, according to Blockchain intelligence firm Chainalysis. But the longer investors remain on the sidelines, the longer those concerns will persist.

That’s the opinion of Andre Cronje, whose previous work at DeFi platforms — Yearn Finance and Curve Finance — has made him an influential voice in DeFi. He’d like to see crypto remain a top priority for regulators, hoping more clarity will encourage wider adoption.

“The prevalence of exploits, hacks and general malicious-intent focus on DeFi protocols has scared a lot of [people],” said Cronje, now a core contributor at Fantom Foundation, developing the Fantom blockchain. “On the flip side, there’s now today even more regulatory uncertainty than we had two, three or four years ago.”

Still, he and others remain optimistic.

Tarun Chitra, co-founder of crypto risk modeling platform Gauntlet, said he sees solutions to DeFi’s three biggest software problems one to two years away. That includes easier-to-use designs, enhanced privacy on blockchains, and improved security to prevent hacks.

In the meantime, the industry will be bracing for a slowdown. Some projects may struggle. But it will also be an opportunity for DeFi to reprioritize, Cronje said.

“In a market like this, people can take a step back, they can analyze, they can breathe a little bit,” he said. “That allows them to better assess what they should be focusing on next.”

©2023 Bloomberg L.P.