Aug 27, 2020

Dell revenue tops estimates on PC boost from virtual learning

, Bloomberg News

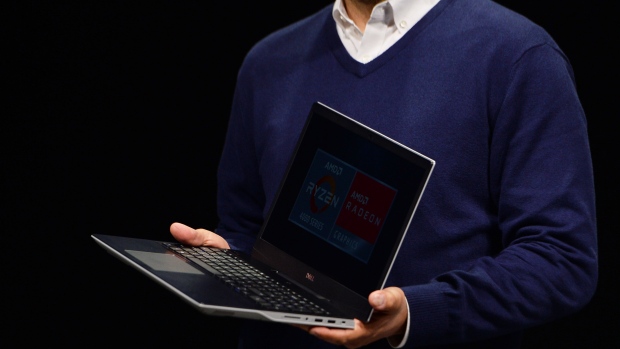

Dell Technologies Inc. reported revenue and profit that topped analysts’ estimates, in a sign of strong demand for personal computers from workers and students stuck at home during the coronavirus pandemic.

Sales were US$22.7 billion in the period that ended July 31, the Round Rock, Texas-based company said Thursday in a statement. Analysts, on average, projected US$22.5 billion, according to data compiled by Bloomberg. The hardware giant reported earnings, excluding some items, of US$1.92 a share, easily beating estimates of US$1.38 a share. Dell shares rose about 4 per cent in extended trading after the results.

Chief Executive Officer Michael Dell is once again looking to revamp the structure of his technology empire, this time to generate more value from his namesake company’s 81 per cent stake in publicly traded software maker VMware Inc. Dell said in a July filing that it may look to spin off VMware. Any deal wouldn’t happen before September 2021 at the earliest, for a tax-free transaction, the company said.

In the meantime, the company has been contending with the pandemic-fueled recession, which has reduced corporate demand for its data-center hardware. But Dell’s efforts to refresh its PC lineup as consumers work, study and entertain themselves from home have paid off.

“We saw strength in the government sector and in education, with orders up 16 per cent and 24 per cent, respectively, as parents, teachers and school districts prepare for a new frontier in virtual learning,” Jeff Clarke, Dell’s chief operating officer, said in the statement.

Revenue from consumer devices jumped 18 per cent to US$3.2 billion, the company said. PC sales to business clients dropped 11 per cent to US$8 billion. Server and networking sales fell 5 per cent to US$4.2 billion. Storage hardware revenue declined 4 per cent to US$4 billion. VMware’s revenue climbed 10 per cent to US$2.9 billion.

Dell’s flexible buying options have struck a chord with business clients who want to adopt new technology without paying for all of it upfront. The company’s recurring revenue came in at US$6 billion in the last quarter, up 15 per cent from a year earlier.

Dell said that it paid off US$3.5 billion of debt in the last period. The company has long-term debt of US$43.6 billion as of July 31. After borrowing heavily to fund its acquisition of storage company EMC Corp., Dell is pursuing an investment-grade credit rating.