May 26, 2022

Dell's sales top estimates on strong office PC growth

, Bloomberg News

Dell Technologies Inc. surged the most in two years after reporting quarterly revenue that topped analysts estimates on strong demand for business PCs and networking services, a sign that companies have been upgrading their systems as workers return to the office.

The shares jumped 13 per cent to US$49.58 at the close Friday in New York, the largest single-day rally since March 2020. Dell’s stock has fallen about 12 per cent this year, which is less than many of its tech-sector peers.

Sales climbed 16 per cent to US$26.1 billion in the fiscal first quarter, which ended April 29. Analysts, on average, projected US$25 billion, according to data compiled by Bloomberg. Revenue was bolstered by a 22 per cent rise to US$12 billion from commercial PCs, one of Dell’s highest-grossing products, the Round Rock, Texas-based company said Thursday in a statement. Profit, excluding some items, was US$1.84 a share, also topping analyst estimates.

Co-Chief Operating Officer Jeff Clarke touted growth across business units in the statement. “We are built to outperform, in a balanced and consistent way across the company.”

Revenue from the Infrastructure Solutions Group, which includes most of Dell’s technology services, increased 16 per cent to US$9.3 billion from a year earlier. Server and networking sales climbed 22 per cent to US$5 billion, while storage revenue gained nine per cent to US$4.2 billion.

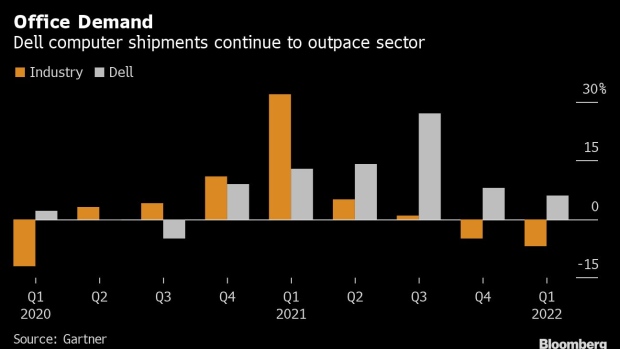

While Dell saw gains, personal computer shipments across the industry declined 6.8 per cent in the first three months of 2022 compared with the same period a year earlier, according to Gartner Inc., an industry analyst. Much of the decline, however, came from reduced demand for Chromebooks used by schools, which saw a huge jump during the pandemic. Business PC shipments increased in the quarter driven by hybrid work and the return to offices, which created a need for new desktop machines, Gartner said.

That trend of greater demand for PCs in the enterprise market was seen in Dell’s numbers. The company’s global shipments increased 6.1 per cent in the quarter, Gartner reported.

Dell said fiscal first-quarter revenue from consumer PCs increased three per cent to US$3.6 billion. Demand is broadly shifting from consumers and PCs to data infrastructure, Clarke said in prepared remarks for the company’s earnings conference call.

The company is navigating supply chain issues and uncertainties about the global economy. Semiconductor shortages and Covid restrictions in China contributed to order backlogs that are likely to continue through at least the current quarter, Clarke said in the prepared remarks. In addition, cheaper component costs helped offset the impact of higher rates in the first quarter, he said, but “in Q2, we expect component costs to turn inflationary and logistics costs to remain at elevated levels.”

In addition to the challenges of managing the supply chain, Clarke said inflation, chip shortages and geopolitical issues have added uncertainty to the economic outlook. Still, “IT demand is currently healthy,” he said.

Revenue in the current period, which ends in July, is projected to be US$26.1 billion to US$27.1 billion, Chief Financial Officer Tom Sweet said on the call. Analysts, on average, estimated US$25.5 billion. Earnings, excluding some items, will be US$1.55 to US$1.70 a share, he said. Analysts projected US$1.45 a share.

“We expect foreign currency to be a headwind for both Q2 and for the full year,” Sweet said.

Last year, Dell spun out VMware Inc., the software vendor acquired in 2016 as part of its $67 billion purchase of EMC. The two companies have remained important business partners since, but the relationship could be weakened by Broadcom Inc.’s planned US$61 billion takeover of VMware, which was announced earlier Thursday, said Bloomberg Intelligence’s Woo Jin Ho.

Michael Dell, chairman and chief executive officer of the company that bears his name, also is board chairman of VMware and supports the sale to Broadcom.