Dec 8, 2022

Democrats to Propose Anti-Big Oil Bill to Close Tax ‘Loopholes’

, Bloomberg News

(Bloomberg) -- Democratic senators are demanding that US oil companies pay more tax at a time when they’re raking in record profits, ratcheting up the war of words between the party and the energy industry.

Seven senators led by Bob Menendez of New Jersey are proposing to remove key tax provisions enjoyed by oil producers such as drilling cost deductions, deepwater royalty relief and carbon capture credits for enhanced oil recovery, according to legislation introduced on Thursday. The “Close Big Oil Tax Loopholes Act” would also tighten up rules around deducting foreign taxes and the “depletion allowance” for oil and gas wells.

Similar legislation has been advanced since at least 2010, with limited success. But Democrats believe public opinion is shifting against Big Oil after this summer’s record nationwide gasoline spike to $5 a gallon and following a string of record profit announcements, largely due to oil and gas price gyrations in the aftermath of Russia’s invasion of Ukraine.

President Joe Biden has frequently attacked executives for not investing enough in new production and enjoying a “windfall from war” in Ukraine. Exxon Mobil Corp. and Chevron Corp. both announced capital spending plans for 2023 that are higher than this year, but refused to alter their medium-term ranges as they focus on financial returns. Exxon also increased its share buyback program for the second time this year, and now plans to repurchase $50 billion through 2024.

Read more: Exxon lifts share buyback to $50 billion after record profit

Separately, Menendez is reviving a legislative effort, alongside Rhode Island Democratic Senator Jack Reed, to spur companies to more quickly develop their oil and gas holdings, by slapping a $10-per-acre annual fee on non-producing federal leases. The bill — the “Use It or Lose It Act of 2022” — dovetails with a series of proposed leasing changes outlined by the Interior Department and measures advanced on Capitol Hill since at least 2008.

The bills signal that some Democrats, emboldened by their success at the midterm elections, are unlikely to ease off on their attacks on oil producers just because elections are over.

“The American people shouldn’t have to subsidize Big Oil CEOs and shareholders while families are hit with high prices at the pump,” Menendez said. The tax loopole bill puts “American taxpayers ahead of the corporate oil industry who for far too long have been enjoying economic windfalls on the backs of hardworking Americans.”

The timing of the bill proposals is notable given the few weeks left in the current Congress. Republicans have been broadly opposed to such legislation and some GOP support would be needed to pass through the Senate. The legislation would likely stall in the House, where Republicans will have a majority next year.

Exxon Mobil and Chevron, along with many domestic peers, posted record earnings in the second and third quarter of this year when oil prices averaged more than $100 a barrel. Prices have since declined due to demand concerns in China and economic slowdowns elsewhere, but the relationship between the Biden administration and the oil industry remains tense.

Chevron Chief Executive Officer Mike Wirth spoke out against a prior threat from Biden for a windfall profits tax. Such measures go against the administration’s stated goal of more, not less oil production, he said at at the Economic Club of New York earlier this month.

“Most things you want more of, you don’t add taxes to,” he noted. Earlier this year, Wirth said “mixed signals” coming out of the administration, especially regarding climate change, were in part to blame for companies being conservative with their future investment plans.

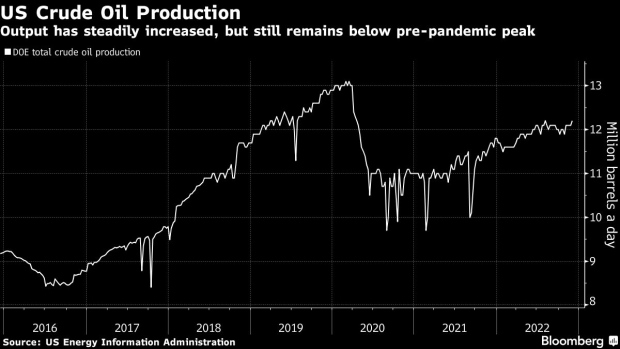

US oil production has been growing steadily over the past two years, but still remains about 1 million barrels a day below its peak of 13 million barrels a day before the pandemic. Industry executives point to Biden’s anti-oil rhetoric in part for the slow rebound. But the administration frequently cites the thousands of leases oil companies are sitting on but not using as evidence the industry favors pocketing the proceeds from high prices rather than reinvesting in new production.

Menendez’s “Use It or Lost It Act” proposes to tackle this problem. The bill “is intended to disincentivize oil companies from holding onto non-producing leases in order to inflate the reserves that they boast to shareholders, while limiting supply and gouging consumers at the pump,” the statement from the senator’s office said.

“The oil industry is utilizing less than half of the federal land that they already have, all while declining to increase production and raking in record profits.”

--With assistance from Jennifer A. Dlouhy.

(Updates with Exxon and Chevron’s spending budgets in fourth paragraph.)

©2022 Bloomberg L.P.