Sep 27, 2021

Derivatives Set for $15 Trillion Switch in Libor Test Run

, Bloomberg News

(Bloomberg) -- Global banks are about to get a comprehensive blueprint for how derivatives worth several hundred trillion dollars may be finally disentangled from the London Interbank Offered Rate.

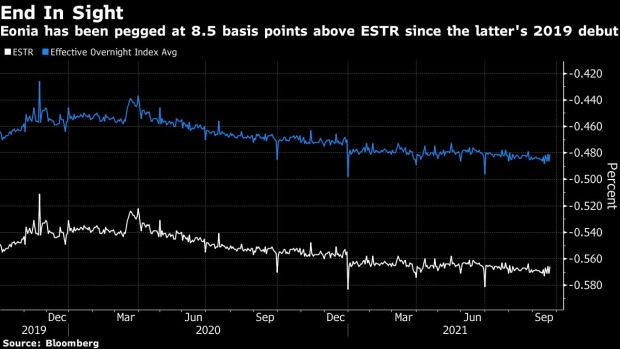

Clearing houses are preparing a synchronized shift of about 13 trillion euros ($15 trillion) of interest-rate swaps to the new euro short-term rate, ESTR, next month. The process is a critical step toward retiring the Euro Overnight Index Average, part of the bedrock of Europe’s financial system.

The move by CME Group Inc., LCH Ltd. and Eurex Clearing AG is a test case for their impending transitions from Libor starting later this year. It’s part of a global effort to phase out discredited and unreliable benchmarks after multiple scandals, and replace then with more trusted alternatives.

Eonia, which underpinned more than 100 trillion euros of financial instruments in 2019, will be discontinued by early January. Financial firms will be watching for insight into how upcoming transitions for euro, yen, sterling and Swiss franc Libor will unfold in December before those benchmarks retire at year end. A similar process will eventually sweep through the vast dollar Libor market.

“It’s an industrial scale migration and will effectively be a trial run for the Libors,” said Joe Kohler, partner at law firm Reed Smith in London. “This is a headache taken away from banks with clearing houses resolving large portfolios.”

The move will cause sudden shifts in the value of trades, and clearing houses will distribute cash compensation between members to prevent winners and losers emerging.

The switch will happen around the weekend of Oct. 16, with the vast bulk at LCH. It’s shifting swaps on between 12 and 13 trillion euros of notional debt, and has already carried out two dry runs in June and July, according to Phil Whitehurst, head of service development, rates at the firm.

“There’s lots of bilateral engagement with firms and contingencies in case things don’t go smoothly on the day despite all the planning,” he said. “We’re feeling very confident.”

Eurex will move about 350 billion euros to ESTR, and CME will shift 42.6 billion euros. Uncleared swaps will probably convert at the same time, according to Sunil Cutinho, president of CME Clearing.

Libor Next

Next up is the synchronized shift for non-dollar Libors, and attention will then turn to the U.S., where a date is yet to be set to move swaps to the Secured Overnight Financing Rate, the main replacement benchmark.

Unlike other Libors, key dollar tenors have been extended until mid-2023 to allow the market to get fully prepared.

Wall Street will be particularly keen to see how the Eonia transition boosts liquidity in its replacement rate, said Priya Misra, global head of interest rate strategy at TD Securities in New York. For years liquidity has struggled to build in SOFR, though it has gathered pace in recent months.

“I’m fairly confident it should work out,” Misra said of the ESTR switch. However, “there are always operational risks in any exercise on one day with a massive number of participants involved. This is no exception.”

Even if that goes smoothly, the group overseeing the dollar Libor transition is warning firms against over reliance on clearing houses to do an 11th-hour transfer.

“With just three months until no new Libor, we urge everyone with Libor exposures to immediately take action and base new contracts on forms of SOFR,” said Tom Wipf, chairman of the Alternative Reference Rates Committee and a vice chairman of institutional securities at Morgan Stanley.

On the Eonia-ESTR move, calculating compensation shouldn’t be an issue because they are set with a standard 8.5 basis-point spread. “It’s a very simple mathematical process,” said CME’s Cutinho.

But the transition will change counterparties’ risk profiles and force them to rehedge their positions in bond markets, said Philip Freeborn, chief operating officer at Delta Capita and a former executive at Barclays Plc.

Global banks will also need to overhaul their systems to accommodate new trading data from clearing houses and communicate the changes to their clients, including regional and savings banks, according to Jan Rosam, a partner at EY in Germany. Firms will also need to rebook their trades.

“Everyone around the world with an Eonia swap will need to transition their book,” said Rosam. “To bring this together in one or two days is quite difficult.”

(Updates with ARRC comments on dollar Libor)

©2021 Bloomberg L.P.