Aug 12, 2022

Derivatives Suggest a ‘Sell-the-News’ End to the Ethereum Rally

, Bloomberg News

(Bloomberg) -- Ether is surging in anticipation of a groundbreaking software upgrade to its blockchain. Sophisticated traders are positioning for the rally to continue until that happens -- and then for the cryptocurrency to plummet afterward.

Speculators in derivatives markets are scooping up call options to bet on an Ether advance into September, when the upgrade is supposed to happen. Yet futures and options are suggesting they’re expecting the price to drop after the event in what analysts at Glassnode say could be a “sell-the-news”-type of situation.

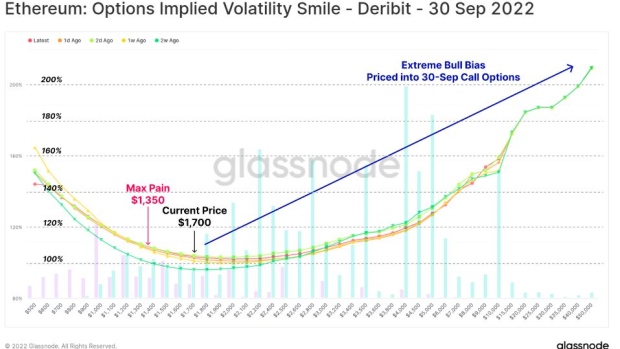

September call options “dwarf” put options, with traders waging Ether’s price could rise to around $2,200 from its current $1,800 level, according to Deribit data compiled by Glassnode. There’s even significant open interest out to $5,000. But for the month after the update, there’s little demand for calls and greater demand for downside protection, suggesting that the traders are hedging or speculating on downside risk then, said Glassnode analysts.

“Post Merge, the left tail is pricing in significantly higher implied volatility, indicating traders are paying a premium for ‘sell-the-news’ put-option protection post-Merge,” Glassnode analysts wrote in a note.

Ethereum’s upgrade has been long-awaited and news around it has been welcomed by investors, who have over the past month pushed its token’s price up by roughly 80%. The blockchain is set to facilitate a move from the current system of using miners to a more energy-efficient one using staked coins. The switch to this so-called proof-of-stake system is expected to happen soon after being kicked down the road for several years. On Wednesday, Ethereum completed its last test before the upgrade, and developers said the main event should take place next month.

But though there’s a lot of excitement around the Merge, not everyone’s convinced it will go without a hitch. It’s “very dangerous” not to consider the outcome the update doesn’t go smoothly, according to Kevin Zhou at Galois Capital, a crypto hedge fund.

Zhou says he envisions that after the Merge, the old, so-called proof-of-work chain supported by powerful computers called miners will continue to exist in a slightly modified form and split, with POS making up about 95% of value and POW grabbing the remaining roughly 5%.

“There’s a lot of burying-the-head-in-the-sand behavior,” Zhou said. He suggested some ways to play the event, including going long spot Ether and short September and December quarterlies, among other strategies. The idea for some of the strategies is to be able to grab more proof-of-work-blockchain’s coins, which will be tradeable.

Ethereum’s blockchain update has created enough excitement in recent days that options open interest for the token has reached $6.6 billion, surpassing Bitcoin’s -- at $4.8 billion -- for the first time, according to Glassnode. Ether OI is close to setting an all-time high.

But there are many outstanding questions as to what happens post-Merge. Though Ethereum adoption has increased, fees -- which are fundamental to forecasting the staking yield and inflation rates -- need to, based on previous cycles, reverse course for a new bull cycle to commence, according to Jamie Douglas Coutts at Bloomberg Intelligence. Macro inputs like liquidity and yields have become the primary determinants of cycle bottoms, as happened in 2018, he said in a note.

Many investors are likely to borrow Ether before the Merge by using other assets as collateral, in order to get more forked proof-of-work-chain’s coins, said Marc Zeller, head of developer relations at Aave.

And as they seek to grab more EthereumPOW tokens, investors are expected to prepare software bots to crawl various DeFi apps on the forked EthereumPOW chain and exchange worthless assets such as stablecoins not supported on the chain for EthereumPOW, he said.

“The second the Merge happens there will be front-running bots that will instantly find every block of POW to empty liquidity pools of Uniswap and others on EthereumPOW,” he said. “The goal is to sell as many tokens as they can -- to get as many EthPOW -- the only asset on EthereumPOW chain that may have some kind of value.”

©2022 Bloomberg L.P.