Jun 22, 2022

Deutsche Bank Looks Back to 1780s for Parallel to US Bond Rout

, Bloomberg News

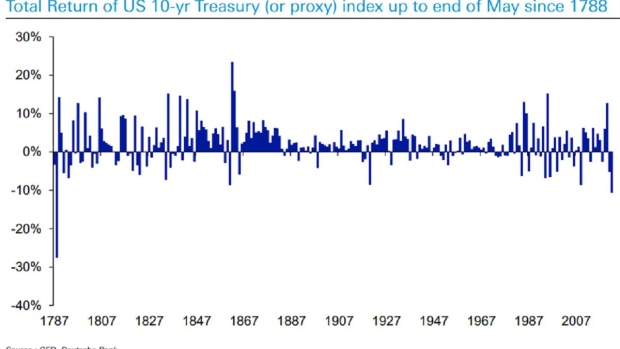

(Bloomberg) -- Not since 1788 -- the year before the founding of the Treasury -- have US bonds fallen so much, according to a calculation by Deutsche Bank AG strategists.

Jim Reid, the firm’s head of credit strategy and thematic research, published a note this week highlighting how 2022 has been one of the worst years in history for the bond market.

The strategists cited an unconventional index from Global Financial Data, which strings together centuries of returns using proxies of US 10-year debt. Their benchmark includes Boston City notes in the 1830s, quotes recorded by Hunt’s Merchants’ Magazine and Martin’s Boston Stock Market, and Liberty Bonds sold to finance World War I.

By that measure, the roughly 10% drop in 10-year Treasuries this year is the steepest since bond losses exceeded 25% in 1788, according to the GFD index cited by Deutsche Bank.

California-based GFD is known for building market indexes that go back centuries by combining traditional feeds and historical records. It has indexes on equities dating to 1601, the beginnings of the stock market in Amsterdam.

Whether benchmarks that stitch together so much history are a useful way of looking at modern markets is probably up for debate among investors. The US financial system, of course, isn’t anything like it was in the 1700s.

“The way the US was organised back then is very different. I wouldn’t compare like-for-like,” said Geoffrey Yu, a strategist at BNY Mellon in London.

Still, it’s one way of illustrating the difficulty that investors have endured this year. “It’s been a perfect storm for bond markets that we’ve never seen before,” Yu added.

The yield on the 10-year note has more than doubled since the end of 2021, rising to 3.14% from 1.51%. That’s the biggest increase in yields since 1984, based on returns for this time of year.

The losses in equities are also one for the history books. With just seven trading days left until the end of June, the S&P 500 is down 21%. The last time the index had fallen this much during the first six months of any year was in 1970, according to data compiled by Bloomberg.

The S&P 500 Hasn’t Had Such a Bad First Half Since the Nixon Era

©2022 Bloomberg L.P.