Jun 29, 2022

Deutsche Bank Sees Bitcoin Returning to $28,000 by Year-End

, Bloomberg News

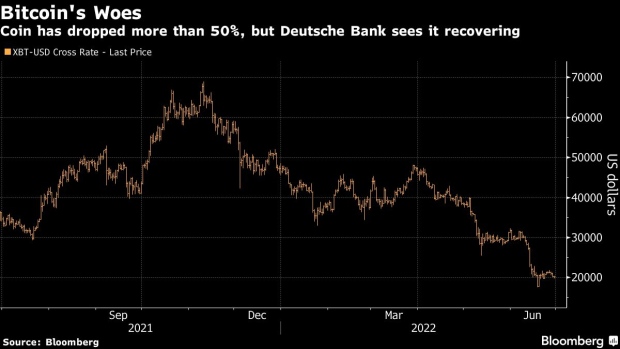

(Bloomberg) -- Given how closely it has been trading with US stocks, Bitcoin could reach as high as $28,000 by the end of the year, according to an analysis from Deutsche Bank.

Bitcoin, the world’s largest digital token, has slumped in 2022 amid a risk-off mood driven by rate hikes and inflation fears. The analysis by Marion Laboure and Galina Pozdnyakova suggests a more-than 30% rally from the coin’s Wednesday trading level of around $20,000 -- though even that price-point leaves the token trading at less than half its November peak.

Cryptocurrencies have been -- since November -- increasingly correlated to benchmarks like the tech-heavy Nasdaq 100 and the S&P 500, Laboure and Pozdnyakova said. The bank’s strategists predict the S&P will recover to January levels by year-end and Bitcoin may come along for the ride.

The digital currency is more like diamonds -- a highly marketed asset -- rather than gold, a stable safe-haven commodity, the duo wrote.

Bitcoin failed to live up to predictions by pundits and market-watchers that it would prove to be an investor refuge, posting losses of more than 50% this year. Digital coins have underperformed stocks, bonds and commodities during the market-wide rout as the removal of excess liquidity by major central banks created downward pressure on their prices. Gold, on the other hand, held up much better.

Laboure and Pozdnyakova tell the tale of De Beers, a major player in the diamond space, which was able to change consumer perception about diamonds thanks to its advertising efforts.

“By marketing an idea rather than a product, they built a solid foundation for the $72 billion-a-year diamond industry, which they have dominated for the last eighty years. What’s true for diamonds, is true for many goods and services, including Bitcoins,” they said.

The analysts also point to some of the troubles that have gripped the crypto space in recent weeks, including turmoil at certain digital-asset hedge funds and lenders.

“Stabilizing token prices is hard because there are no common valuation models like those within the public equity system. In addition, the crypto market is highly fragmented,” they said. “The crypto freefall could continue because of the system’s complexity.”

©2022 Bloomberg L.P.