Feb 23, 2023

Deutsche Bank Studied Credit Suisse Deal Options Before Overhaul

, Bloomberg News

(Bloomberg) -- Deutsche Bank AG looked at buying parts of Credit Suisse Group AG assets as recently as last fall after the Swiss firm became engulfed by a series of scandals and financial hits, according to people with knowledge of the matter.

The German lender analyzed individual businesses such as the Swiss firm’s asset management and wealth management units, people familiar with the matter said. The plan inside Deutsche Bank was to be able to move should attractive parts of the bank come on the market, the people said.

The project has been on hold since Credit Suisse announced an overhaul in October, though could get reactivated if the Swiss bank again considers disposals, the people said. They asked not to be identified as the deliberations are private. It’s at least the second time in recent years Deutsche Bank Chief Executive Officer Christian Sewing has brainstormed about a potential move on the Swiss firm.

Representatives for Deutsche Bank and Credit Suisse declined to comment.

Deutsche Bank’s scenario planning towards the end of 2022 came as Credit Suisse assessed disposals in the run-up to its strategy announcement. A key pillar of the plan is divesting its securitized products business to investment firm Apollo, while spinning off its capital markets business into a new company, though it stopped short of further significant sales.

Read More: Credit Suisse Disposal Plans Gain Pace as Revamp Clock Ticks

Since taking charge, Sewing has held official takeover talks with Commerzbank AG and informal ones with UBS AG, though the discussions were ultimately broken off without a deal. He has been a forceful advocate for European banking consolidation and he’s said he’d want to be buyer rather than a target once deals take off.

Credit Suisse’s revamp presented by CEO Ulrich Koerner has done little to resolve the crisis of confidence surrounding the lender. The bank’s shares, which have lost about three quarters of their value over the past two years, have dropped sharply after the announcement. Analysts and investors expressed concern about huge deposit outflows and the bank’s ability to pull off a complicated overhaul.

The Swiss lender’s “management is undergoing a very difficult and complex process of restructuring — although on track with initial guidance – the franchise is deteriorating so far faster than expected,” JPMorgan analysts led by Kian Abouhossein said in a note on Friday. They put estimated valuations of 10 billion Swiss francs ($10.7 billion) on the wealth management unit and 1.4 billion euros on asset management.

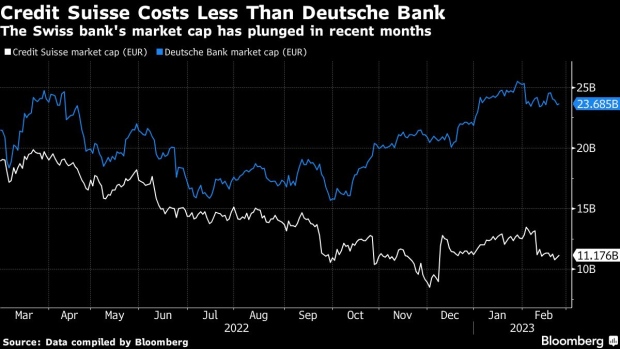

The Swiss bank’s market value is now less than half that of Deutsche Bank’s, which has just completed a successful turnaround. The German lender recently reported the highest annual profit in over a decade and promised several billion euros in investor payouts over coming years.

Credit Suisse Supervisory Board Chairman Axel Lehmann has said that the Swiss lender isn’t for sale.

Deutsche Bank is seeking to grow its wealth management and asset management units, and buying Credit Suisse or parts of it would give big boosts to both. The Swiss bank’s wealth management operations in particular are much bigger, though its unlikely the Swiss bank would be interested in selling a business that sits at the center of its strategy.

While Sewing has repeatedly touted acquisitions as a way to grow, he’s cautioned that it’s very difficult to pull of a cross-border deal, especially a large one, within the confines of European regulation.

The CEO is also wary of large deals because Deutsche Bank is still working to complete the messy takeover of domestic competitor Postbank over a decade ago. That deal led to billions of euros in unexpected spending and it has tied up vast staff resources, creating a constant irritation for Sewing ever since he was running the retail clients unit eight years ago.

(Updates with analyst comment in eighth paragraph)

©2023 Bloomberg L.P.