Nov 14, 2017

DHX sees profit boost from Peanuts, Strawberry Shortcake acquisitions; shares rise

The Canadian Press

TORONTO -- DHX Media Ltd. is beginning to see returns from its investments over the past three years to build its library and now expects spending to be more moderate, chief executive Dana Landry said Tuesday.

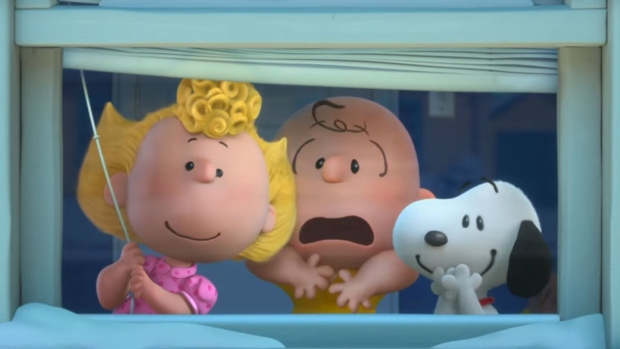

He said acquiring the Peanuts franchise -- in a US$345-million debt-financed deal that closed at the end of June -- has created a more diversified, stable business for DHX.

"Over 40 per cent of our revenues now come from licencing consumer products, compared with 18 per cent during the same period last year," Landry said.

The Halifax-based company (DHXb.TO) has a three-pronged strategy: create or acquire child- and family-oriented content, generate revenue globally from its content and license merchandise based on its characters.

"The plan is to leverage our expertise to grow our existing brands through new original content," Landry said. "This will allow us to add new categories and new territories in our consumer products portfolio."

But he also said the company is putting a high priority on improving its free cash flow and is on track to reduce operating costs and leverage while improving revenue.

The company said it will realize its target of $11 million in total annualized acquisition-related synergies and cost reductions by the end of its 2019 financial year.

The comments came as DHX reported it earned $8.1 million or six cents per share, compared with a profit of $1.4 million or a penny per share a year ago.

Revenue for the three months ended Sept. 30 -- for the first quarter of its 2018 financial year -- grew to $98.6 million, compared with $53.8 million in the same quarter last year, in part because of its acquisition of the Peanuts and Strawberry Shortcake characters earlier this year.

Landry's positive tone during the call with financial analysts was a marked contrast to his remarks while discussing DHX Media's fourth quarter earlier this year, when he said the company had taken "corrective actions" to address "disappointing financial results."

On Oct. 2, less than a week after Landry made that comment, DHX Media launched a strategic review of its alternatives -- including the possible sale of all or part of the company.

Landry said Tuesday that discussions with business partners and cost-cutting measures are proceeding as usual while a special committee of DHX directors undertakes the review.

Executive chairman Michael Donovan said the strategic review was launched in the context of DHX's acquisition of the Peanuts franchise, but he declined to make specific comments about how long it will take.

He said that DHX sees Peanuts as a "core" holding but "we're committed to exploring all options to enhance shareholder value. We'll update shareholders when the process is complete."